-

×

The Complete Guide to InDesign Styles By Erica Gamet

1 × $5,00

The Complete Guide to InDesign Styles By Erica Gamet

1 × $5,00 -

×

Seven Figure Freedom By Michael Killen

1 × $62,00

Seven Figure Freedom By Michael Killen

1 × $62,00 -

×

Writing Great Chapters By Daniel David Wallace

1 × $23,00

Writing Great Chapters By Daniel David Wallace

1 × $23,00 -

×

Blockchain On Demand - Enterprise Bundle

1 × $85,00

Blockchain On Demand - Enterprise Bundle

1 × $85,00 -

×

Shorts Master Editor By Noam Tryber

1 × $15,00

Shorts Master Editor By Noam Tryber

1 × $15,00

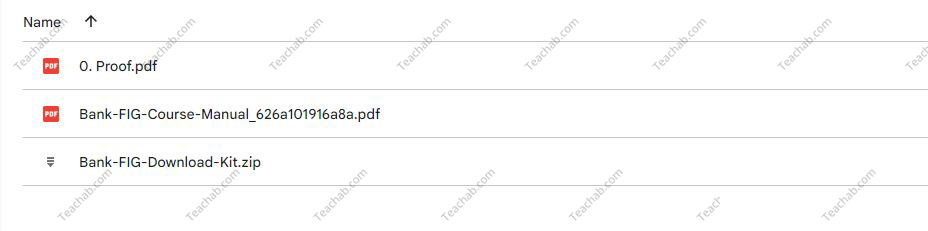

Bank and Financial Institution Modeling Course (Bank – FIG Modeling) By Matan Feldman – Wall Street Prep

$399,00 $69,00

SKU: 40086tuLqJ5cr

Category: Finance

Tags: Bank – FIG Modeling, Bank and Financial Institution Modeling Course, Matan Feldman, Wall Street Prep

Bank and Financial Institution Modeling Course (Bank – FIG Modeling) By Matan Feldman – Wall Street Prep – Instant Download!

Description:

Bank and Financial Institution Modeling Course (Bank – FIG Modeling)

Bank analysis differs significantly from that of other industries, necessitating adjustments and unique approaches in valuation methodologies. Wall Street Prep’s Bank Modeling & FIG Modeling course provides comprehensive guidance through a bank’s financial statements, distinct drivers, and regulatory framework.

Through a case study on Valley National Bank, participants will construct a fully integrated financial statement model, residual income (RI) model, and dividend discount model (DDM).

Upon completion, participants will have mastered the construction of fully integrated financial statement models, RI models, and DDMs.

What You Will Learn

Section One: Building a Bank Forecast Model

– Construct an advanced bank forecast model, projecting asset and liability balances, interest rates, and spreads using industry best practices.

– Effectively forecast the loan portfolio, investment securities, and deposits.

– Understand the modeling and forecasting of allowances for loan losses and net charge offs (NCOs).

– Model regulatory constraints and analyze effects on leverage, capital ratios, and profitability.

– Forecast net interest income (NII), asset yields, funding costs, and interest-earning assets (IEA) and liabilities (IBL) with an approach that considers typical disclosure gaps, maintains internal consistency, and avoids common modeling pitfalls.

– Utilize common forecast approaches for non-interest income and expenses such as fees and compensation.

– Identify the most appropriate “plugs” in a bank model to ensure balance and address circular reference issues.

Section Two: Building a Bank Valuation Model

– Utilize results from the forecast model to construct a residual (excess returns) income model.

– Develop an adjusted dividend discount model using industry best practices for banks.

– Analyze the impact of regulatory capital constraints on valuation.

– Establish assumptions about return on equity (ROE), risk-weighted assets (RWA), cost of equity, and minimum capital ratio consistent with a multiple-stage model.

– Compare other valuation approaches such as comps and DCF, and assess the strengths and limitations of each.

Course Samples

– Bank Modeling Course Guide Sample

– Bank Modeling Industry Primer Sample

– Sample Bank Modeling Template

Frequently Asked Questions:

1. Innovative Business Model:

- Embrace the reality of a genuine business! Our strategy involves orchestrating a group purchase, wherein we collectively distribute costs among members. Utilizing these pooled funds, we acquire in-demand courses from sales pages and make them accessible to individuals facing financial constraints. Despite potential reservations from the original authors, our customers value the affordability and accessibility we offer.

2. The Legal Landscape: Yes and No:

- The legality of our operations resides in a gray area. While we lack explicit approval from course authors for resale, a legal nuance comes into play. During the course acquisition, the author did not specify any restrictions on resale. This legal intricacy presents both an opportunity for us and a benefit for those seeking budget-friendly access.

3. Quality Assurance: Revealing the Real Deal:

- Delving into the core of the matter – quality. Procuring the course directly from the sales page ensures that all documents and materials are identical to those obtained through conventional means. However, our differentiator lies in going beyond individual study; we take an extra step by facilitating resale. It’s crucial to note that we are not the official course providers, which means certain premium services are not included in our package:

- No coaching calls or scheduled sessions with the author.

- No access to the author’s private Facebook group or web portal.

- No entry to the author’s exclusive membership forum.

- No direct email support from the author or their team.

We operate independently, aiming to bridge the affordability gap without the additional services offered by official course channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Bank and Financial Institution Modeling Course (Bank – FIG Modeling) By Matan Feldman – Wall Street Prep” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.