-

×

eCom Fast Track Bundle By Justin Phillips

1 × $15,00

eCom Fast Track Bundle By Justin Phillips

1 × $15,00

Crypto Training by Justin Goff

$97,00 $5,00

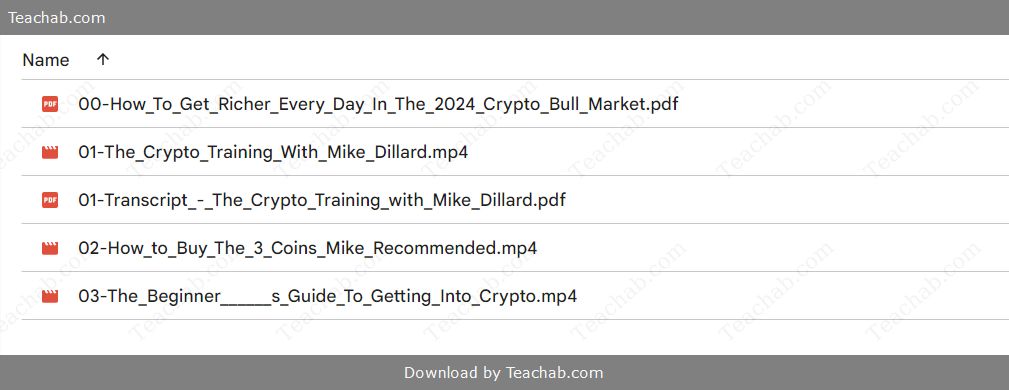

Crypto Training by Justin Goff – Digital Download!

Let embark on a thrilling odyssey with a course that ignites your curiosity and uncovers extraordinary secrets, propelling your passion for discovery into a realm of unparalleled adventure and wonder

Crypto Training by Justin Goff

Overview

Crypto Training by Justin Goff

In a financial environment that is constantly changing and where cryptocurrencies are the most popular asset class and cultural phenomena, it is imperative that people receive the right information. Let me introduce you to Justin Goff, a name that appeals to both experienced and inexperienced investors due to his dedication to explaining the nuances of bitcoin trading. The goal of Goff’s training program is to give participants the knowledge and abilities needed to successfully negotiate the volatile world of digital assets. This program covers a wide range of topics, from basic ideas to sophisticated trading techniques, and is tailored to suit different skill levels. Goff’s curriculum has the potential to completely change the way you approach cryptocurrency investing, regardless of your level of experience. Whether you’re a busy professional looking to diversify your investments or a keen newbie hoping to learn about blockchain technology.

Goff stresses practical learning by emphasizing real-world applications, which enables participants to actively interact with the material. The program’s design, which offers solutions that may be easily incorporated into daily life, displays a strong awareness of the difficulties faced by contemporary investors. In an increasingly complex and competitive cryptocurrency industry, educational programs like as Goff’s offer a vital lifeline to those who wish to partake in it successfully. This post will go over the specifics of the crypto training program, including its salient characteristics, teaching styles, and how it makes it easier for people with hectic schedules to enter the world of cryptocurrencies.

An outline of the training program for cryptocurrency

The bitcoin training course offered by Justin Goff is a well-designed learning resource that aims to provide students a deeper comprehension of digital currencies and provide them with the necessary trading techniques. This course acts as a kind of bridge for students moving from more conventional investing to the cutting edge world of cryptocurrency. It gracefully serves a wide range of users, from total beginners who have never touched cryptocurrency to seasoned traders looking to hone their craft in the face of a constantly changing market.

Imagine crossing a bridge to enter a bustling market full of opportunities—that is, if you know how to cross it. Goff’s teaching serves as the crucial link that enables people to venture into the unknown with caution but assurance. Through the integration of academic knowledge and practical experience, the curriculum contributes to the deciphering of the intricacies involved in cryptocurrency trading. Goff also highlights the significance of risk management techniques, giving participants the ability to make decisions that are in line with their financial objectives.

Expert opinions, like as those of well-known investor Mike Dillard, are incorporated into the curriculum to further enhance it and give participants access to the knowledge of seasoned experts who have successfully navigated the cryptocurrency ecosystem. This comprehensive approach guarantees that participants understand the fundamental ideas and sophisticated trading strategies necessary to succeed in this thriving market.

| **Key Features** | **Description** |

| Comprehensive Curriculum | Covers blockchain fundamentals, trading strategies, and risk management. |

| Interactive Learning | Engages participants through Q&A and hands-on activities. |

| Real-Time Market Analysis | Prepares participants for dynamic trading environments. |

| Lifetime Access | Provides continuous access to course materials and resources. |

Thus, Justin Goff’s cryptocurrency training program stands out as a well-rounded educational venture, ready to equip learners with the knowledge and skills necessary to navigate the complexities of the cryptocurrency market with confidence.

Important Aspects of Justin Goff’s Instruction

A number of important elements set Justin Goff’s training program apart and together give participants an engaging experience. The program’s extensive curriculum, which goes beyond simple theory to cover important topics like blockchain basics, trading strategies, risk management, and investment techniques, is one of its most remarkable features. This integrated approach explores the most complex facets of bitcoin investing while guaranteeing that participants have a solid foundation.

The interactive learning environment that is developed during the course is another noteworthy feature. Instead than following a conventional lecture style, the curriculum encourages participation through real-time Q&A sessions, group discussions, and practical exercises. The ability to connect directly with students and instructors promotes a shared understanding and collaborative learning environment, which is especially important when negotiating complicated concepts that need clarification.

Moreover, Goff’s curriculum offers real-time market analysis, giving participants the opportunity to assess and analyze current market trends and build the competencies required to make well-informed financial decisions based on real data. This particular aspect gives attendees real-world expertise and gets them ready for the unpredictable and volatile nature of the bitcoin market.

The program also gains from the professional perspectives of well-known business insiders, such Mike Dillard. He provides participants with the means to successfully traverse the complexities of trading without becoming bogged down by needless study, thanks to his significant experience and proven track record in discovering attractive coins.

Lastly, Goff’s curriculum places a strong emphasis on real-world application, teaching participants essential skills like market trend analysis and portfolio diversification. The intention is for learners to leave the program with the knowledge and skills needed to make wise decisions in a constantly shifting environment.

| **Key Features** | **Summary** |

| Comprehensive Curriculum | Deep Dive into multiple cryptocurrency topics. |

| Interactive Learning | Engaging sessions that foster collaboration and critical thinking. |

| Real-Time Market Analysis | Skills for assessing live data for timely decision-making. |

| Expert Insights | Knowledge from industry veterans, enhancing learning outcomes. |

| Practical Application | Focus on skills like diversification and analysis. |

Overall, the multifaceted approach of Justin Goff’s training effectively prepares participants to engage with the cryptocurrency landscape competently, equipping them with both theoretical knowledge and practical skills.

Available Training Formats: Live, Recorded, and More

Different formats are available within Justin Goff’s training program to accommodate varying learning styles and schedules. Live training programs that give participants an interactive experience are the main focus. With real-time discussions and the opportunity for participants to raise questions and get prompt answers, these live seminars aim to promote direct participation. Engaging with peers and instructors in these environments allows participants to exchange insights and benefit from one another’s experiences, which improves the learning process.

Apart from in-person instruction, attendees can access recorded sessions at their convenience following the event. Due to erratic schedules, personal obligations, or time zone variations, some people might not be able to attend live classes; but, with this dual method, they can still benefit from the training whenever it’s convenient for them. Additionally, having access to recorded content allows participants to review difficult subjects or important ideas, which helps them retain important information.

A key component of Goff’s training program’s promotion of diversity is the mix of recorded and live sessions. It caters to a wide range of users, from those who value direct, in-person communication to those who gain from a more contemplative and customized learning setting.

| **Training Format** | **Description** |

| Live Training Sessions | Interactive sessions with immediate engagement. |

| Recorded Sessions | Flexibility to learn at your own pace. |

| Q&A Segments | Opportunity to address specific queries directly. |

Ultimately, the blend of training formats offered in Justin Goff’s crypto training creates an environment conducive to learning, catering to diverse preferences and lifestyles while maximizing the benefits of comprehensive cryptocurrency education.

Detailed Price Structure

Among the many options for learning about cryptocurrencies, Justin Goff’s training program stands out for its unusually low price in addition to its excellent content and delivery. Right now, the all-inclusive program is available for a very affordable $99, which is far less than similar training offerings that may cost anywhere between $499 and $699. This accessibility makes it possible for a wider range of people—both novice and experienced investors—to gain essential knowledge and understanding without having to bear unaffordable costs.

This price method makes key investment knowledge and skills accessible to anyone who is willing to learn, which is in line with Goff’s goal of democratizing crypto education. Through the initiative, people from a variety of backgrounds can engage in the constantly changing world of cryptocurrencies without having to make large upfront investments, as financial obstacles are removed.

The lifelong access to the training’s recorded sessions and additional materials further increases its value. This tool helps participants review and reinforce important concepts as new developments in the cryptocurrency market occur by allowing them to go back to the course material at any time.

| **Pricing Details** | **Past Pricing** | **Current Pricing** |

| Mike Dillard’s Programs (Prev. Range) | $499 – $699 | $99 |

| Justin Goff’s Current Offering | Comprehensive training and support | Affordable option |

| Lifetime Access | Revisit materials whenever needed | Yes |

In summary, the competitive pricing structure of Justin Goff’s crypto training program not only encourages participation but also demonstrates a commitment to making cryptocurrency education more approachable and accessible for everyone, irrespective of their financial background.

Techniques for Active People in Crypto

Busy people frequently struggle with time constraints when it comes to participating in the bitcoin market, therefore effective techniques are crucial. For individuals who are looking to invest in cryptocurrency but are juggling many duties, Justin Goff’s training program offers workable options.

A crucial tactic that has been addressed is capitalizing on the knowledge of experts. Participants can make wise investment decisions without devoting hours to research by heeding the advice of seasoned investors like Mike Dillard. By utilizing the experience of experts, this method greatly expedites the decision-making process for individuals.

Simplifying investment strategies is another suggested strategy. Goff advises investors to devote a significant amount of their capital to reputable cryptocurrencies like Bitcoin because they have stability and long-term promise. The leftover money can then be invested in a small number of altcoins that have been handpicked by specialists to reduce complexity and maximize growth potential.

Furthermore, the training’s case studies and real-world success stories improve comprehension by demonstrating how these tactics may be applied successfully. Successful cryptocurrency investments like Chainlink and Polkadot, for instance, are concrete illustrations of how listening to professionals may result in profitable outcomes without requiring in-depth research.

Goff emphasizes the significance of timing and market movements for time-pressed investors. The program gives participants the tools they need to engage successfully throughout bullish market cycles by encouraging them to be aware of times of projected market strength, which are frequently driven by institutional investments or technical advancements.

Furthermore, the goal of Goff’s program is to establish an atmosphere that prioritizes accessibility and cost, making it simpler for those with hectic schedules to start investing in cryptocurrencies. At $99, the course offers valuable insights without needing a substantial initial cash outlay.

Justin Goff’s training curriculum emphasizes professional suggestions, simplified tactics, case studies, and market trends to cater to the demands of individuals who are busy but still interested in investing in cryptocurrencies.

Making Crypto Investing Simpler

It can be intimidating to navigate the bitcoin market, particularly for people who are time-constrained. In order to reduce the complexity of cryptocurrency investing, Justin Goff’s method focuses on doable tactics that will expedite the process and make it easier for people with hectic schedules to handle.

The principle of aggressively leveraging expert recommendations is fundamental to this strategy. Goff saves participants the time and effort by urging them to follow experienced investors such as Mike Dillard, who has a track record of success in bitcoin investing. Rather, by taking a more simplified approach, investors can benefit from Dillard’s insights, which lowers the entry hurdles and makes it easier to make investing decisions.

Goff also stresses the significance of constructing a straightforward yet successful financial portfolio. He recommends, for example, allocating 90% of one’s portfolio to well-known cryptocurrencies like Bitcoin, which can act as a reliable anchor. A lesser portion can be given to altcoins that show promise in the interim, providing for healthy diversity without becoming overly complex.

In addition, Goff uses case studies and real-world examples to reaffirm the fundamentals of profitable investing. The participants are presented with prior success stories of people who used professional insights to generate significant returns, demonstrating how making well-informed decisions and acting upon them could result in financial success even in the absence of thorough study. Through the presentation of participant experiences, Goff offers sympathetic tales that reduce the process’s intimidating nature and increase its approachability.

A crucial element in streamlining cryptocurrency investing is emphasizing prompt market entry. Goff teaches participants to watch for signs of impending price hikes and trends that point to favorable market circumstances. In the world of cryptocurrency, where quick price swings are typical, timing is crucial. Keeping a watch on the market can easily result in profitable investments.

In the end, Justin Goff’s training program streamlines, increases efficiency, and requires less time to complete, enabling busy people to participate with confidence and increase their chances of success in the thriving cryptocurrency market.

Time-Efficient Methods of Trading

For busy individuals entering the world of cryptocurrency, time-efficient trading methods are paramount. Justin Goff’s training program emphasizes a set of streamlined trading strategies designed specifically to decrease time commitment while maximizing financial potential in the market.

One of the most effective methods highlighted is the practice of following expert recommendations. Goff specifically notes the ease of leveraging insights from trusted market experts like Mike Dillard. Instead of spending countless hours analyzing charts and researching varying cryptocurrencies, busy traders can invest their time wisely by aligning with Dillard’s proven strategies, thus simplifying their investment journey.

Another recommended method includes employing a Buy and Hold strategy, which allows participants to do the heavy lifting upfront and then step back. Goff advocates allocating a significant portion of an investment to Bitcoin, treating it as a long-term asset while minimizing daily trading activities. This tactical approach is perfect for individuals with limited time, as it requires minimal engagement compared to active trading while still positioning oneself in the growing crypto market.

Additionally, Goff encourages learners to utilize training resources effectively. The structured training program provides core insights and methods for selecting promising cryptocurrencies, allowing busy individuals to capitalize on expert-generated content without the need for extensive research. By focusing on a handful of key coins known for their growth potential, busy traders can streamline their decision-making processes effectively.

Time-efficient trading means being able to seize market opportunities without being continuously tied to screens. Goff introduces alert systems for breakouts where investors set predetermined price levels to receive notifications, enabling them to act quickly without the need to obsessively monitor the market. This balance between vigilance and efficiency ensures that busy traders remain engaged without being overwhelmed by daily market fluctuations.

By presenting these techniques focusing on expert advice, strategic portfolio management, and proactive alert systems Justin Goff’s training equips busy individuals with the means to trade effectively while respecting their time constraints, illustrating how anyone can thrive in the crypto market without sacrificing the priorities of their daily lives.

Making Effective Use of Professional Suggestions

Justin Goff highlights how important professional advice is to a successful investing strategy, especially in the volatile world of cryptocurrencies. It can be a great shortcut to success for time-pressed people who don’t have the knowledge or experience to sort through the market’s complexity by paying attention to the advice of seasoned investors like Mike Dillard.

Dillard’s track record of accurately spotting potentially valuable coins attests to the validity of his observations. Goff mentions, for example, profitable ventures into cryptocurrencies such as Chainlink and Polkadot, which were chosen in accordance with Dillard’s advice. Participants acquire the ability to make educated selections without having to conduct in-depth independent research by placing their trust in the advise of experts.

Goff’s investment philosophies support simplified investment routes by urging investors to concentrate on a limited number of high-potential coins and rely on professional selections. This strategy not only reduces the workload of ongoing market research but also enables a concise approach that lessens the dangers involved in investing in obscure assets.

Goff also stresses the need of continuing to engage in regular educational activities and stresses the significance of maintaining a connection to professional analysis. As market conditions change, investors can adjust their tactics to stay informed and in a position to take advantage of new possibilities thanks to this ongoing learning.

Through the promotion of a framework that skillfully makes use of professional recommendations, Justin Goff’s training program enables busy people to lessen the complexity involved in cryptocurrency investing. By using this approach, participants can gain access to the knowledge of seasoned investors without having to bear the burden of exhaustive market research and analysis on their own.

Insights from Mike Dillard

In the realm of cryptocurrency investing, the insights of industry experts can provide invaluable guidance to newcomers and experienced traders alike. Mike Dillard, a seasoned investor known for his strategic acumen, has garnered attention for his successful track record in identifying profitable opportunities in the crypto market.

Dillard’s investment approach focuses on simplifying the investing process, allowing busy individuals to navigate the complexities of cryptocurrency without excessive research. By following his expert recommendations, investors can effectively reduce their workload while still capitalizing on profitable ventures. This is particularly beneficial for those juggling professional commitments, as it allows them to participate in the cryptocurrency market without committing significant time to analysis.

The importance of following expert picks cannot be understated. Dillard emphasizes the significance of timing in the crypto market, often highlighting the need to enter positions strategically to maximize returns. By sharing his extensive experience, Dillard provides insights into identifying opportunities for investment during favorable market conditions essentially training participants to think like seasoned experts.

Additionally, Dillard’s reliance on well-researched projections informs his recommendations. For example, he has successfully invested in cryptocurrencies such as Chainlink and Polkadot, showcasing his ability to identify coins with substantial growth potential before they become widely recognized. This approach encourages individual investors to cultivate a mindset of awareness and understanding when assessing investment opportunities.

Overall, Mike Dillard’s insights, combined with Justin Goff’s educational approach, empower participants to make informed and strategic decisions within the cryptocurrency realm. By incorporating expert guidance into their investment strategies, busy individuals can enjoy the benefits of informed investing while effectively managing their time and responsibilities.

The Value of Adhering to Expert Selections

Following the recommendations of experts in the field of cryptocurrency investment can significantly increase an investor’s chances of success. The value of listening to and learning from successful investors such as Mike Dillard is emphasized by Justin Goff and his curriculum. Dillard’s insights can help investors make profitable judgments without requiring busy people to conduct a great deal of study.

Leveraging the experience is the main advantage of heeding the advice of experts. Through years of market engagement, investors have access to a plethora of expertise that helps them avoid typical errors and missteps. This is especially important in a market as volatile as cryptocurrencies, where snap decisions can result in large profits or severe losses depending on timing and research.

Dillard is a reliable choice because of their well-established track record. For instance, people who followed his advice and invested in Chainlink, Polkadot, and Filecoin were able to make significant profits. Even inexperienced investors can access chances usually reserved for more seasoned traders by implicitly following tried-and-true procedures.

Furthermore, the focus on professional recommendations promotes a learning community. As novice investors use Dillard’s advice, they can converse with other trainees in Goff’s program, creating encounters that are mutually beneficial and further their learning process. As members of this group learning setting gradually improve their investment skills, they are empowered and gain confidence.

In the end, giving professional advice priority improves judgment in the volatile bitcoin market. Justin Goff gives learners the skills they need to confidently and successfully negotiate the complexity of trading through in-depth instruction and knowledgeable insights.

Mike Dillard’s Track Record and Strategies

Mike Dillard stands out as a key figure in cryptocurrency investment, renowned for his remarkable track record and strategic insights. His approach primarily revolves around identifying profitable opportunities while emphasizing simplified investing for individuals conquering the complexities of the crypto market.

Investment Approach

Dillard advocates for a strategy of following expert recommendations, allowing investors to make informed decisions without extensive knowledge of technical analysis or market conditions. Justin Goff echoes this sentiment, promoting the concept of “piggybacking” on Dillard’s insights to harness opportunities within the crypto ecosystem.

Successful Investments

Dillard’s sharp instincts for detecting lucrative investments are evidenced through his historical successes. He recognized the potential of Chainlink at a price of $6 and later sold it when it surged to $25. Similarly, he purchased Polkadot at $9 and later cashed out at $34 a testament to his keen ability to spot emerging opportunities early on. Such examples illustrate his knack for identifying winning assets before they become prominent on the market.

Pay Attention to New Trends

In his recent talks, Dillard has emphasized AI-based cryptocurrencies more and more, portraying them as the blockchain’s future. His support of coins like RNDR and AIOZ is indicative of his progressive viewpoint, as he feels that incorporating AI into the cryptocurrency market can greatly increase value and applications.

To sum up, the investing strategies of Mike Dillard are distinguished by a combination of forecasting, professional judgment, and timing. Through the identification of promising initiatives that have the potential to generate significant returns, his tried-and-true methodology give investors the confidence to engage profitably in the quickly changing cryptocurrency market.

Mike’s Upcoming Coin Suggestions

Mike Dillard regularly gives recommendations for forthcoming coins during live training events as part of his continued commitment to helping cryptocurrency investors. These seminars highlight the dynamic and ever-changing character of the cryptocurrency market while also giving attendees advice on effective investments.

For example, in the next sessions hosted by Justin Goff, Dillard will reveal his top cryptocurrencies that he thinks have a lot of room to expand in the next bull market. Attendees may get knowledgeable insights into recently developed cryptocurrencies, especially those related to artificial intelligence, which Dillard believes will lead to revolutionary shifts in the market.

According to Dillard’s projections, certain coins might generate profits of between 10 and 20 times, particularly considering how quickly the cryptocurrency sector is developing. This prediction emphasizes how important it is for investors to stay alert, involved in changing market trends, and flexible in response to new opportunities. Dillard’s ability to predict different assets’ potential gives people a road map for making profitable investments.

Dillard emphasizes in his advice the significance of staying in step with emerging trends and indicators of increasing momentum. He encourages participants to take measured risks and investigate possible routes for wealth growth by providing them with the knowledge necessary to make informed decisions.

In conclusion, Dillard’s impending recommendations highlight the significance of using professional insights as a way to navigate this quickly evolving market and give participants a fascinating look into the future of bitcoin investments.

Investment Techniques

In the world of cryptocurrency, the implementation of effective investment techniques can significantly enhance one’s financial outcomes. Justin Goff and Mike Dillard advocate various strategies to cater to different investor profiles, including both long-term holdings and short-term trading approaches.

Long-Term Holding Versus Short-Term Trading

A fundamental distinction in cryptocurrency investment techniques lies between long-term holding and short-term trading. Each approach presents unique benefits and challenges tailored to varying investor needs and risk appetites.

Long-Term Holding (HODLing)

Long-term holding commonly referred to as “HODLing” involves purchasing cryptocurrencies and retaining them over an extended period, often spanning years. This strategy is predicated on the belief that certain assets will appreciate in value over time, resulting in substantial profits. Key advantages include:

- Reduced Time Commitment: Long-term investors reap the benefits of compounding growth with far fewer transactions involved, allowing them to focus on other commitments without being heavily engaged in day-to-day market movements.

- Favorable Risk Mitigation: Holding established assets like Bitcoin can cushion against volatility, as their value tends to appreciate over longer periods despite short-term price swings.

- Lower Transaction Costs: By trading less frequently, investors save on transaction fees and avoid the emotional stress associated with impulsive trading decisions.

Successful long-term investment requires due diligence in identifying promising projects and understanding the fundamentals driving value appreciation.

Trading in the Short Term

On the other hand, short-term trading refers to methods that concentrate on quickly purchasing and selling cryptocurrencies in order to take advantage of price changes. Typical strategies in short-term trading consist of:

- Day trading involves keeping a careful eye on trends and making and selling cryptocurrency purchases and sales inside the same day in response to market changes.

- Scalping is the practice of making many trades over shorter periods of time in order to profit from small price fluctuations.

- Holding assets for a few days or weeks in order to profit on anticipated price swings driven by market trends is known as swing trading.

Compared to long-term holding, short-term trading requires more time, attention, and active participation, but it can also result in rapid rewards. Additionally, because there is a chance for abrupt changes in the market, the risk is larger.

Comparison of Long-Term Holding and Short-Term Trading

| **Criteria** | **Long-Term Holding** | **Short-Term Trading** |

| **Investment Duration** | Extended (months to years) | Short (minutes to weeks) |

| **Engagement Level** | Lower (less frequent monitoring) | High (constant market observation) |

| **Risk Management** | Mitigated through asset retention | Requires precise timing and strategies |

| **Transaction Fees** | Generally lower (fewer trades) | Higher (multiple trades increase costs) |

Ultimately, the decision to pursue long-term holding or short-term trading largely depends on the investor’s financial goals, risk tolerance, and ability to manage their time effectively. Both strategies hold the potential for success, provided they are implemented thoughtfully and consistently.

Strategies for Managing Risk in Cryptocurrency

In the unpredictable world of cryptocurrencies, both novice and seasoned investors must practice effective risk management. These are a few tactics that can minimize risks and increase possible rewards.

The act of diversification

It is not advisable for investors to put all of their money into one company. Investing portfolio diversification among many cryptocurrencies can effectively mitigate vulnerability to any individual asset. Risks can be efficiently distributed by include well-known cryptocurrencies like Bitcoin and Ethereum together with a number of interesting altcoins.

Orders to Stop Losing

By putting stop-loss orders into place, investors can designate specific exit points for their holdings, allowing for automatic sales in the event that an asset’s price falls below a defined threshold. This method prevents emotional decision-making during volatile markets by limiting possible losses and ensuring discipline.

Evaluation of Risk to Reward Ratios

Investors must to evaluate each investment’s risk-to-reward ratio prior to making a deal. Maintaining a risk/reward ratio of at least 1:2—that is, aiming to gain at least two units for each unit risked—is a widely advised strategy. By using this technique, less advantageous trade possibilities can be found and eliminated.

Meticulous Investigation and Evaluation

In a market full of con artists and badly run projects, doing extensive research is essential. Evaluating the reliability of teams, technologies, and use cases provides information on the chances of long-term viability and success.

Investors can use both technical and fundamental analysis to make well-informed judgments based on hard facts rather than conjecture. Finding possible entry and exit opportunities can be made easier by having a thorough understanding of market trends and patterns.

In conclusion, employing efficient risk management techniques raises the possibility of bitcoin investment success. A proactive approach that emphasizes diversification, stop-loss procedures, and thorough research can help people protect their investment choices from the effects of market volatility.

New Developments in the Crypto Industry

As the cryptocurrency market grows, a number of notable themes have begun to influence its environment. By recognizing these patterns, investors can reduce associated risks and successfully plan for future growth.

Decentralized Finance (DeFi) Integration

The emergence of DeFi signifies a profound change in the way finance functions. DeFi provides decentralized substitutes for conventional financial services, including as lending, borrowing, and trading, by leveraging blockchain technology. Purchasing DeFi projects could offer significant potential for investors looking to diversify their portfolios as this trend continues to grow.

Growing Investments by Institutions

The entry of numerous significant institutional players into the bitcoin market is increasing liquidity and giving the asset class legitimacy. Because institutional investments typically have a longer-term vision, this tendency promotes a more engaging market environment and could result in enhanced price stability.

Put Non-Fungible Tokens (NFTs) First

The use of NFTs has grown significantly, and this trend doesn’t appear to be abating. As cross-industry cooperation and innovation continue to grow, investors interested in unique digital assets—whether in the form of art, music, or gaming assets—should investigate the prospects within this market segment.

Artificial Intelligence in Cryptocurrency

Another trend that is starting to take hold is the incorporation of artificial intelligence into trading tactics. Tools that provide sophisticated data analysis and predictive capabilities have the ability to completely transform trade efficiency. Investors may make better selections in the ever-evolving market by utilizing AI-driven information.

Changes in Regulation

It’s vital to stay up to date on regulatory changes as governments and regulatory agencies continue to closely monitor the bitcoin industry. Adherence to rules has the potential to augment trust and stability in the market, thereby providing complying enterprises with growth prospects.

In conclusion, effective investment planning requires the ability to identify new trends in the cryptocurrency space. Investors can gain an advantageous position in this dynamic landscape by monitoring key trends driving market growth, including as the integration of Decentralized Finance, institutional investments, the increase of NFTs, AI applications, and regulatory developments.

Technologies and Tools

A thorough understanding of the technologies and tools surrounding the cryptocurrency space enhances the investment experience in significant ways. These technologies empower individuals to conduct informed trading, analyze market trends, and manage their portfolios effectively.

Blockchain Technology Explained

At the core of cryptocurrency lies blockchain technology, a decentralized, distributed ledger system that allows transactions to be recorded immutably across multiple nodes. This technology ensures transparency, security, and traceability, making it the backbone of cryptocurrencies. Key characteristics include:

- Cryptographic Security: Blockchain utilizes encryption techniques to secure transaction data and identities, fostering a trustless environment for users.

- Decentralized Structure: Transactions occur across a network of nodes, eliminating the need for intermediaries. This creates transparency and prevents manipulation.

- Smart Contracts: These self-executing contracts automatically complete transactions when predetermined conditions are fulfilled, facilitating decentralized agreements without intermediaries.

Tools for Monitoring Cryptocurrencies

Several tools are available to investors for monitoring cryptocurrency performance and market trends:

- Cryptocurrency Tracking Tools: Platforms like CoinMarketCap and CoinGecko provide real-time market data, price charts, and analytics for various cryptocurrencies, helping investors stay informed.

- Charting Platforms: TradingView and Cryptowat.ch offer advanced charting features, allowing traders to visualize price movements and apply technical analysis for informed trading decisions.

- Market Analysis Tools: AI-driven platforms like Token Metrics utilize machine learning algorithms to generate market forecasts and research, promoting data-driven investment approaches.

Engaging with these technologies allows investors to optimize their strategies and navigate the crypto landscape more effectively.

Society and Assistance

Collaboration and shared learning experiences are encouraged in bitcoin training programs such as Justin Goff’s, where there is a strong sense of community and support. Interacting with other students creates a support system that can greatly improve their educational experiences.

Availability of Live Q&A Sessions

Participants in Goff’s program gain from live Q&A sessions, which let them interact with peers and knowledgeable teachers in-person. Through these participatory forums, participants can ask questions about difficult ideas, which leads to a deeper understanding and increased confidence when navigating the bitcoin market. With the ability to ask questions in real time, participants can tailor their education to suit their own interests and concerns.

Opportunities for Networking with Other Students

The training program’s networking opportunities enhance participants’ experiences even further. Through interactive workshops and group discussions, students may connect to share knowledge and encourage one another as they travel the cryptocurrency path. Developing connections with people who share similar interests lays the groundwork for cooperation, conversation, and friendship, fostering a positive learning environment.

Educational Resources and Supplementary Materials

In addition, Goff’s training course provides an abundance of other materials and learning opportunities. Comprehensive guidelines covering everything from advanced trading tactics to blockchain foundations are included in this curriculum. Participants have access to a multitude of information that enhances their comprehension of important ideas and promotes lifelong learning.

To sum up, the community and assistance that Justin Goff’s crypto training offers are crucial in fostering a cooperative learning atmosphere. Through the use of Q&A sessions, networking opportunities, and comprehensive educational materials, participants are given the tools they need to improve their trading skills and form valuable relationships in the bitcoin industry.

User Testimonials and Reviews

While there may not be many public user reviews and testimonials for Justin Goff’s crypto training program, the course’s features and structure provide strong evidence of its efficacy.

Overview of the Training Program

Goff’s training program is designed to cater to a wide range of investors, from complete novices to seasoned professionals. From risk management techniques to blockchain theory, the curriculum covers every important facet of the bitcoin business and gives students thorough understanding in an approachable manner.

Methods of Instruction

Notably, Goff uses a variety of interactive approaches, such as practical exercises and in-the-moment market research, that are intended to actively involve participants. These components will probably improve comprehension and help students learn important ideas more quickly than they would in a standard lecture setting.

Achievements

Anecdotal evidence indicates that participants in Goff’s program in the past have become more self-assured traders as a result of their training. Many of them attribute their newfound success to the practical insights they received throughout the training. Past attendees can now navigate the cryptocurrency world more skillfully and take advantage of a variety of financial opportunities by making the leap from novice to confident trader.

Development of Useful Skills

Crucially, participant feedback indicates that attendees leave Goff’s course with essential practical abilities. These abilities enable people to interact with the rapidly evolving bitcoin market in an efficient manner, from market analysis strategies to sophisticated risk assessment.

In conclusion, the program’s solid infrastructure and emphasis on real-world applications suggest that participants will benefit, even though explicit user feedback may not be common. With an emphasis on hands-on learning and participation, Justin Goff’s training program is well-positioned to produce knowledgeable investors with a keen understanding of the cryptocurrency space.

Achievements from Past Enrollees

Many success stories from past participants in Justin Goff’s crypto training program have surfaced, demonstrating the course’s transforming potential. A recurring theme among previous attendees is their increased confidence in carrying out cryptocurrency investments as a result of the useful knowledge they acquired.

Many participants said they were able to identify high-potential investment possibilities by effectively using the knowledge they gained from the training sessions. Some have, for example, reported their success stories of investing in altcoins that yielded large returns on their capital after doing so, as advised by Goff and Dillard. These stories of financial success are not single instances; rather, they are a part of a larger pattern in which people who were previously reluctant to participate in cryptocurrencies have become proactive and knowledgeable participants.

In addition, peer collaboration stories highlight the sense of community that Goff’s curriculum cultivates. Groups have been formed by attendees to talk about market trends, exchange thoughts, and work together to examine future investments. A learning community that goes beyond the training curriculum has been developed in this peer-driven setting, promoting continued education and thoughtful conversations about the changing cryptocurrency landscape.

To sum up, the positive testimonies of previous attendees attest to the effectiveness of Justin Goff’s crypto training course. Through the development of a community, important learning experiences, and real-world application, the program gives participants the skills and self-assurance they need to be successful in their cryptocurrency ventures.

Typical Obstacles Learners Face

Although Justin Goff’s training program provides students with invaluable insights into bitcoin investment, there are specific obstacles that participants frequently face as they progress through the curriculum. By identifying these challenges, educators and learners can take proactive measures to overcome them, improving the quality of the educational process as a whole.

Overloading with information

The overwhelming amount of information available in the bitcoin world is one of the main obstacles for learners. Beginners attempting to understand fundamental ideas while keeping up with market trends may find it daunting due to the quick speed of technology advancement and the continuous flow of news. Goff lessens this difficulty by organizing the course material to emphasize important lessons and concentrate on pertinent details, enabling learners to increase their understanding gradually.

Fear of Volatility in the Market

New investors may experience anxiety due to the inherent volatility of the bitcoin market, which may cause them to delay making decisions. Goff’s training emphasizes effective risk management techniques in order to allay this worry. The curriculum equips participants with the knowledge and skills to confidently handle market changes by teaching them how to assess risks and set clear parameters for investments.

Intolerance for the Learning Curve

Investors have occasionally expressed frustration with the cryptocurrency learning curve. This is a market that is changing quickly, so you have to be constantly adapting and learning new things. Goff exhorts participants to embrace the process, stressing that continuous exposure to important ideas, market dynamics, and trading tactics will eventually lead to proficiency.

Over-Selection of Professional Advice

While it’s sometimes a good idea to heed the advice of experts, some students find it difficult to completely rely on other people’s perspectives when making decisions. Goff advises individuals to develop their analytical skills while using professional recommendations as a jumping off point. This harmony guarantees that investors hone their judgment by supplementing professional guidance with research instead of replacing it.

Through the identification and resolution of these typical learning hurdles, Justin Goff’s training program strengthens participants’ resolve to become competent and informed cryptocurrency investors while also preparing them to overcome setbacks.

Responses to the Training’s Effectiveness

Participants in Justin Goff’s crypto training program have consistently noted numerous distinct benefits of the course structure, and the curriculum has received excellent reviews regarding its overall effectiveness.

Entire Course

Participants value the comprehensive program, which covers everything from sophisticated trading tactics to blockchain basics. The incorporation of fundamental concepts guarantees that novices can participate proficiently and comprehend the complexities of the industry.

Engaging Interactive Education

The advantages of interactive learning including Q&A sections, practical exercises, and real-time market analysis are frequently emphasized by learners. With the help of these components, participants can consolidate their knowledge in a collaborative environment that promotes critical thinking, increasing engagement and retention.

Utilizing Skills

A common comment made by participants is how much more confident they feel using the abilities they acquired during the program. Numerous individuals have effectively utilized the insights from Goff’s program to make well-informed financial decisions, demonstrating the usefulness of the training material.

Continuous Participation and Assistance

Evaluations frequently highlight the importance of the community component, which allows participants to stay in touch with one another and carry on conversations after training sessions. This nurturing atmosphere places a strong emphasis on group development and is an essential tool for lifelong learning.

In conclusion, the evaluations of Justin Goff’s training program’s efficacy are encouraging. Thanks to its all-encompassing strategy, powerful interactive teaching techniques, and continuous community support, the program regularly gives users the confidence to participate in the ever-evolving bitcoin market.

Cryptocurrency’s Future with Justin Goff

According to Justin Goff, the bitcoin investing landscape is about to undergo a significant upheaval. Goff’s method of teaching equips students to adjust to the always changing digital asset ecosystem and position themselves for success within it.

Specifically, Goff identifies important impending developments like the expected approval of Bitcoin ETFs as potential stimulants to attract new investors to the market. The fact that cryptocurrencies have gained regulatory clearance marks a significant turning point for the industry and could result in increased institutional use and general public awareness among consumers.

Goff highlights the necessity for people to empower themselves with information and tactics in order to take advantage of possible possibilities during this time of expansion. In addition to teaching fundamental knowledge, his training program instills useful investing strategies that are in line with the best practices for navigating this revolutionary period.

Because of the participatory format of Goff’s training, participants are certain to be well-prepared to make decisions regarding new trends and technology. This dynamic learning environment promotes the development of a proactive mentality while highlighting the significance of ongoing education and adaptation for successfully navigating the bitcoin domain.

According to Justin Goff, the future of bitcoin investing ultimately comes down to accessibility, scalability, and well-informed decision-making. Goff makes sure participants are ready to interact with the changing market landscape with confidence and take advantage of new opportunities as they present themselves by giving them customised strategies and insights.

Prospects for Cryptocurrency Investments in the Long Run

With the growing integration of digital currencies into the global financial system, investing in cryptocurrencies looks to have a bright future. Regarding the industry’s prospects for growth, Justin Goff is upbeat and believes that new applications and investment opportunities will arise from blockchain technology’s inventiveness.

Goff emphasizes the value of investor education, pointing out that knowledgeable investors are better equipped to handle future market movements and changes. Through the development of a strong knowledge base and the simultaneous improvement of analytical skills, investors are better equipped to respond quickly and efficiently to changing market conditions.

Another factor supporting Goff’s bullish view is the growing acceptance of cryptocurrencies by both traditional financial institutions and individual investors. Although it has an impact on market stability, cryptocurrencies are becoming more widely accepted due to reasons including improved technology infrastructure and more benevolent regulatory frameworks.

Forecasts for Cryptocurrencies Powered by AI

Justin Goff observes that artificial intelligence and cryptocurrencies are becoming more closely related, pointing to a time when AI will be a major factor in determining trading tactics and financial choices. He cites particular coins that have been labeled as “AI cryptocurrencies,” implying that these initiatives might profit greatly from the further spread of AI technology integration.

Goff’s observations highlight how important it is for investors to stay alert and follow trends that show promise. Traders set themselves up for significant profits as the industry innovates by seeing and funding innovative AI-based projects early on.

Adapting Techniques for a Shifting Market

It is impossible to overestimate the significance of flexibility and shifting tactics in the quickly expanding bitcoin space. To keep investors knowledgeable and competitive, Goff supports a strategy that prioritizes continuing education and being flexible in response to changes in the market and technology.

In addition to preparing people for the modern market, Justin Goff’s training cultivates a mindset that will allow for adaptation in the face of future obstacles by encouraging participants to embrace new tools and techniques. By taking a proactive approach, investors can better grasp opportunities and avoid becoming overwhelmed by the market’s volatility, which is a hallmark of the cryptocurrency space.

In summary, cryptocurrencies have a bright and promising future. Justin Goff equips participants with knowledge, practical tactics, and an optimistic outlook to meet the opportunities and difficulties that this changing investment environment will present.

Frequently Asked Questions:

Innovation in Business Models: We use a group purchase approach that enables users to split expenses and get discounted access to well-liked courses. Despite worries regarding distribution strategies from content creators, this strategy helps people with low incomes.

Legal Aspects to Take into Account: Our operations’ legality entails several intricate considerations. There are no explicit resale restrictions mentioned at the time of purchase, even though we do not have the course developers’ express consent to redistribute their content. This uncertainty gives us the chance to offer reasonably priced instructional materials.

Quality Control: We make certain that every course resource we buy is the exact same as what the authors themselves provide. It’s crucial to realize, nevertheless, that we are not authorized suppliers. Therefore, the following are not included in our offerings: – Live coaching sessions or calls with the course author.

– Entry to groups or portals that are only available to authors.

– Participation in closed forums.

– Straightforward email assistance from the writer or their group.

Our goal is to lower the barrier to education by providing these courses on our own, without the official channels’ premium services. We value your comprehension of our distinct methodology.

Be the first to review “Crypto Training by Justin Goff” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.