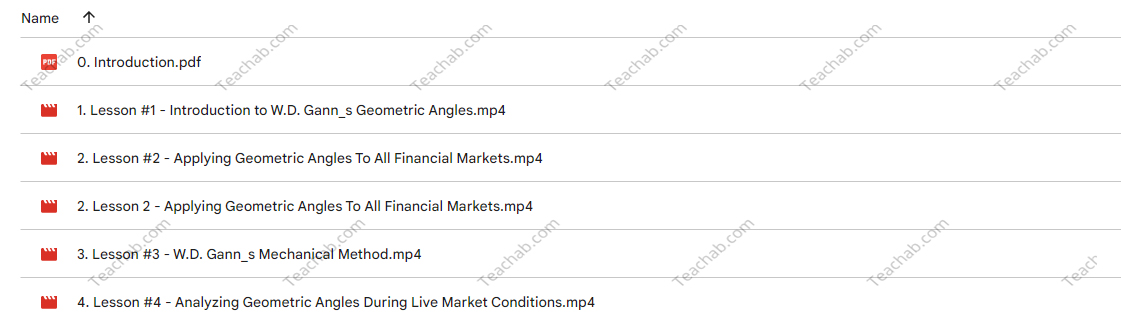

Geometric Angles Applied To Modern Markets By Sean Avidar

$399,00 $39,00

Geometric angles applied to modern markets – Instant Download!

Let’s embark on a captivating adventure to uncover remarkable insights that spark your curiosity and elevate your understanding

Geometric Angles Applied To Modern Markets By Sean Avidar

Overview

Geometric angles applied to modern markets

In the ever-evolving landscape of financial trading, innovative techniques are continuously reshaping strategies and methodologies. The course titled “Geometric Angles Applied to Modern Markets” by Sean Avidar takes an intriguing approach to trading by drawing upon the insights of the legendary trader W.D. Gann. The course centers around the application of geometric angles in market analysis, representing a fusion of time and price that Gann believed was pivotal for understanding movements in the financial markets. This comprehensive course empowers traders with essential skills to identify critical support and resistance levels, predict market movements, and make informed trading decisions. As we explore the various facets of this educational endeavor, readers will come to appreciate the depth and nuance incorporated within the framework of Gann’s methodologies.

Introduction to geometric angles

The first section of Avidar’s course establishes a strong foundation for understanding the principles of geometric angles and their relevance in market analysis. Gann posited that the world of finance is intricately linked to geometric concepts, and angles serve as pivotal indicators of price action. By elaborating on how geometry influences market movements, traders can develop a deeper appreciation for price patterns and behavioral trends.

The significance of angles in trading

Angles are more than abstract mathematical concepts; they represent a visual and analytical way to comprehend market dynamics. Avidar emphasizes that geometric angles can provide insights into potential future price changes, offering traders a framework to engage with market trends systematically. The application of these angles allows traders to delineate distinct support and resistance levels, leading to informed trading positions.

For example, a 45-degree angle can signify a balance between price and time, while a sharper angle may indicate acceleration or pressure in market movement. By recognizing these angles, traders can better anticipate trend reversals or continuations, integrating geometric principles into their decision-making processes. Ultimately, the introduction to these concepts instills a profound respect for the role geometry plays in market analysis, empowering participants to wield these insights effectively.

The foundational concepts of Gann’s methods

Delving deeper into Gann’s methodologies, Avidar presents a comprehensive overview of several foundational concepts. The essence of Gann’s technique resides in the belief that history tends to repeat itself, creating patterns that can be deciphered through geometric analysis. By understanding historical price movements and relating them to geometric angles, traders can foresee possible future movements within the context of time and price.

Recognizing the cyclical nature of markets allows traders to not only predict but also capitalize on market behaviors that may appear erratic or unhinged upon first glance. Whether it’s tracing past patterns or employing degrees to analyze future benchmarks, Avidar’s teachings advocate for a data-driven approach grounded in the age-old wisdom of Gann’s methods.

Timekeepers and scaling

Transitioning from the foundational concepts, the course moves into the importance of timekeeping and scaling, essential elements for any trader seeking to utilize Gann’s techniques effectively. Avidar introduces the concept of timekeepers as tools for chart scaling, illustrating their pivotal role in translating geometric angles across different markets and timeframes.

Utilizing timekeepers

Timekeepers serve as a way to synchronize market movements with relevant time intervals, facilitating the application of geometric analysis to live trading scenarios. Avidar emphasizes that traders who incorporate timekeepers into their practice can identify periods of volatility and stability more readily. This foresight enables them to position themselves advantageously by trading within a framework that acknowledges the natural ebb and flow of market trends.

For instance, a trader utilizing a timekeeper can observe and gauge how price movements are related to specific time intervals, allowing for greater analysis of potential turning points. By plotting geometric angles against timeframes, traders gain the advantage of foresight, making it less likely for them to miss lucrative trading opportunities.

Scaling charts effectively

Scaling charts effectively involves adapting Gann’s angles to fit the context of a trader’s specific market focus. To apply geometric angles appropriately, adapting the scaling method is crucial for visualizing price movements comprehensively. Avidar prompts traders to employ custom scaling techniques to suit their trading styles and objectives, ensuring the application of geometric principles remains relevant and tailored to individual needs.

This personalized approach allows traders to dynamically engage with the market, utilizing angles to provide clarity amidst the noise often found in financial environments. By fostering adaptability, Avidar helps participants recognize how geometric angles can serve as powerful tools for navigating various market conditions while retaining the essence of Gann’s original teachings.

Mechanical methods in trading

In the course’s third section, Avidar dives into Gann’s mechanical methods, revealing how these techniques can enhance a trader’s operations. This segment is critical for those looking to combine theory with practice, as Avidar examines buying and selling points through a structured lens.

Practical trading management strategies

Avidar presents a series of mechanical methods that resonate with both novice and seasoned traders. These strategies offer practical insights into efficient trading management, encompassing precise entry and exit points based on geometric analysis. This hands-on approach demystifies Gann’s concepts, translating them into actionable steps that traders can employ in various market scenarios.

For example, traders are introduced to a set of mechanical rules that allow them to enter trades at optimal times, based on the interplay between price movements and established geometric angles. A systematic application of these rules can significantly boost trading performance, aligning with the core principles of risk management and profit optimization.

Enhancing trading success

Ultimately, the course equips participants with a toolbox of trading techniques designed to enhance overall performance. Avidar encourages traders to cultivate discipline by adhering to these mechanical methods, understanding that consistency and foresight are the keystones of successful trading. Such a foundation allows for clearer decision-making, removing emotion from the process while grounding decisions in the reality of market geometry.

The stories of traders who have implemented these mechanical strategies into their operations serve as motivation, illustrating the tangible benefits of Gann’s techniques. By vividly showcasing the successes achieved through disciplined applications of mechanical methods, Avidar inspires a sense of potential within his students, laying the groundwork for ongoing development.

Live market application

The course reaches a pinnacle with engaging live market sessions, providing traders with the unique chance to apply their knowledge in real-time scenarios. Avidar understands that theory, while essential, gains substantial value when it transitions into practical application.

Real-time decision-making

During these live sessions, participants find themselves navigating actual market conditions, utilizing geometric angles to assess price action and spot lucrative trading opportunities. This immersion allows traders to bolster their confidence, experience the excitement of real trading, and witness firsthand how their understanding of angles can translate into successful decisions.

The hands-on experience cultivates a deeper comprehension of the moment-to-moment dynamics that govern the market. Rather than relying on hypothetical situations, traders can learn how to adapt quickly, apply Gann’s techniques under pressure, and refine their strategies based on live feedback.

A deeper understanding of market dynamics

This deeper exploration of real-time decision-making emphasizes Avidar’s commitment to fostering active learning and skill development. The practical application highlights the significance of psychological resilience in trading while reinforcing the intuition that stems from experience.

Participants are guided to reflect on their choices and analyze outcomes critically, thereby sharpening their market instincts. The live sessions encourage collaborative learning, where traders can share insights and learn from each other’s mistakes and successes, creating a comprehensive educational experience that extends beyond individual efforts.

Controversial but insightful

Despite the profound insights offered by Gann’s methods, it’s important to acknowledge the controversy that has surrounded these techniques throughout the years. Avidar addresses this sentiment in his course, helping traders understand the multi-faceted nature of Gann’s principles and their varying interpretations.

Skepticism towards Gann’s methods

While some practitioners tout immense successes using Gann’s geometric angles, others remain skeptical, attributing doubts to the esoteric and unconventional nature of his theories. These divergent views highlight the subjective experiences that traders encounter in applying Gann’s techniques, creating space for alternative interpretations of effectiveness.

For instance, many traders may experience initial frustration when employing Gann’s methodologies, only to discover their value over time as understanding deepens. This progression emphasizes the importance of patience and perseverance in the path of applying geometric analysis. It also points to the necessity of understanding that each trader’s journey is unique what resonates with one may not connect with another.

Diverse interpretations of Gann’s techniques

Amid the skepticism, however, lies a rich vein of insight. Many traders who have committed to Gann’s techniques attest to transformative experiences in their trading careers. Participants engaged in Avidar’s course can witness firsthand accounts of traders who have adopted the geometric approach, illustrating the potential for success that is achievable through dedication and thoughtful engagement with Gann’s teachings.

The ongoing study of Gann’s methods, even amidst controversy, signifies an atmospheric interest in innovative trading techniques. It reflects an evolving understanding of market analysis, which continues to negotiate the bridge between skepticism and belief. Avidar’s course provides a structured space for such inquiries, encouraging participants to explore Gann’s principles critically while identifying their applications in contemporary trading environments.

Conclusion

In reviewing “Geometric Angles Applied to Modern Markets” by Sean Avidar, one can appreciate how the teachings encapsulate both the intricacy and elegance of W.D. Gann’s theories. Through a blend of foundational concepts, practical applications, and live market experiences, participants are equipped to navigate the world of trading equipped with insights that marry mathematics and financial analysis. While the road ahead may be layered with challenges and subjective interpretations, the structured learning environment crafted by Avidar inspires traders to refine their methodologies and embrace the unique opportunities presented by geometric angles in market analysis. In the tapestry of modern trading, Avidar’s course stands as a testament to the enduring legacy of Gann’s work, as well as a beacon for those seeking to define their own trading journeys through the lens of geometry.

Frequently Asked Questions:

Innovation in Business Models: We use a group purchase approach that enables users to split expenses and get discounted access to well-liked courses. Despite worries regarding distribution strategies from content creators, this strategy helps people with low incomes.

Legal Aspects to Take into Account: Our operations’ legality entails several intricate considerations. There are no explicit resale restrictions mentioned at the time of purchase, even though we do not have the course developers’ express consent to redistribute their content. This uncertainty gives us the chance to offer reasonably priced instructional materials.

Quality Control: We make certain that every course resource we buy is the exact same as what the authors themselves provide. It’s crucial to realize, nevertheless, that we are not authorized suppliers. Therefore, the following are not included in our offerings: – Live coaching sessions or calls with the course author.

– Entry to groups or portals that are only available to authors.

– Participation in closed forums.

– Straightforward email assistance from the writer or their group.

Our goal is to lower the barrier to education by providing these courses on our own, without the official channels’ premium services. We value your comprehension of our distinct methodology.

Be the first to review “Geometric Angles Applied To Modern Markets By Sean Avidar” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.