HOODRICH CREDIT MENTORSHIP

$197,00 $39,00

Hoodrich Credit Mentorship: A Comprehensive Review – Immediate Download!

Let’s embark on a captivating adventure to uncover remarkable insights that spark your curiosity and elevate your understanding

HOODRICH CREDIT MENTORSHIP

Overview

Hoodrich Credit Mentorship: A Comprehensive Review

In today’s financial landscape, where individuals often seek the means to manage their credit effectively, mentorship programs have emerged as a beacon of hope. Among them, the Hoodrich Credit Mentorship Program stands out as a program geared not just towards credit repair but also towards fostering financial literacy and strategic thinking in credit management. This program emphasizes the intricacies of credit card stacking, offering participants a chance to delve deep into the world of credit. However, the experiences of participants may vary significantly, creating a complex tapestry of opinions and reviews. In this article, we will explore various aspects of the Hoodrich Credit Mentorship, contrasting the enthusiastic feedback with the criticisms it has faced, ultimately inviting potential participants to reflect deeply before making a commitment.

Understanding the Hoodrich Credit Mentorship Program

The Hoodrich Credit Mentorship Program is fundamentally rooted in the idea of self-empowerment through knowledgeable guidance. It intends to provide participants with essential skills for building a robust credit profile. The program covers topics ranging from credit repair strategies to advanced credit card stacking techniques, equipping individuals with vital skills necessary for navigating the modern financial system. It leans heavily on the idea that with the right knowledge, individuals can transform their credit standings and enhance their financial futures.

The influx of information, especially in an age defined by data overload, can be overwhelming. Mentorship programs like Hoodrich aim to simplify this process, offering a streamlined path to financial literacy. It positions itself not just as an educational tool, but also as a community, enabling individuals to connect through platforms like Telegram. This aspect fosters a sense of belonging and mutual support among participants, encouraging engagement and collaboration, reminiscent of how a coach guides their team through the complexities of the game.

However, the allure of such programs invariably raises questions: Does the mentorship live up to its promises? To assess this, one must look closely at the experiences shared by those who have participated in the program. While many participants express positivity about what they have learned and the potential benefits offered, others shed light on pitfalls, particularly concerning customer service issues.

Mixed Reviews and Participant Experiences

When it comes to mentorship experiences, the phrase “one size fits all” seldom holds true. The feedback surrounding the Hoodrich Credit Mentorship Program is highly polarized. On one hand, participants have lauded the educational content provided a goldmine of strategies aimed at demystifying credit management.

Positive Feedback

Here’s what many found favorable about their experience:

- Knowledge Acquisition: Many participants reported that the program successfully equipped them with practical knowledge regarding credit repair and stacking techniques. The information, delivered through webinars and community discussions, was often described as actionable and valuable.

- Networking Opportunities: Participants expressed appreciation for the chance to connect with others on similar financial journeys. The communal aspect of the program enables individuals to share their experiences, akin to a team working together towards a shared goal, which can significantly enhance the learning process.

Critical Concerns

However, it is essential to highlight the contrasting experiences shared by some:

- Accessing Resources: A considerable number of participants reported difficulties in accessing mentorship resources, which raises concerns about the program’s organizational rigor. The dream of financial literacy was overshadowed by frustrations stemming from these accessibility issues.

- Customer Service: An alarming theme emerged regarding customer service; many expressed dissatisfaction, indicating that when problems arose, responses were often slow or inadequate. The promise of support turned elusive, leading to feelings of isolation and frustration among participants who felt their concerns were not being addressed.

Balancing the Outcomes

The stark contrast in experiences ranging from enthusiastic endorsements of the mentorship to expressions of discontent emphasizes the necessity for potential participants to carefully evaluate whether this program aligns with their needs. The disparity suggests that while the program can be immensely beneficial for some, it may not deliver the same level of satisfaction for others. This notion is captured beautifully in the saying, “Every rose has its thorn,” reminding us that even the most promising opportunities can come with drawbacks.

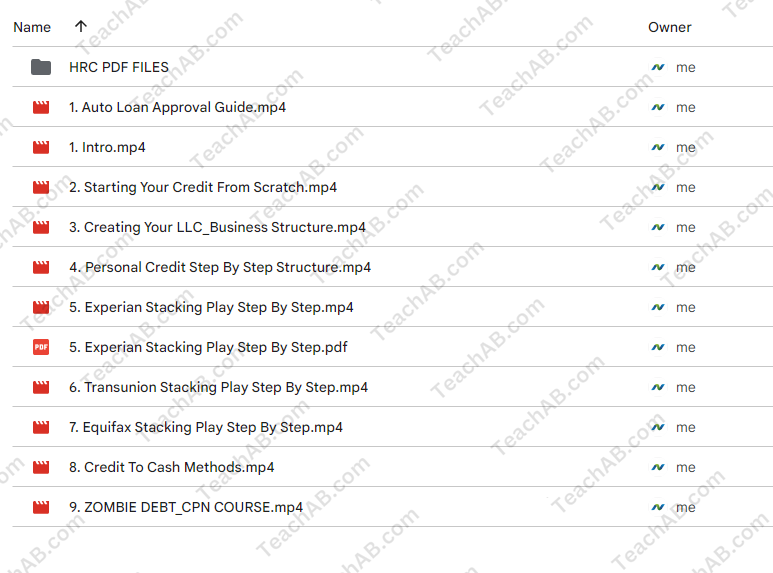

Key Features of the Program

To understand the Hoodrich Credit Mentorship Program further, it is crucial to delve into its key features and benefits, as well as the aspects that draw participants in. Below is a consolidated overview of what the program offers:

| Feature | Description |

| Credit Repair Strategies | Theoretical and practical methods for improving credit scores. |

| Credit Card Stacking | Techniques to maximize benefits from multiple credit cards. |

| Financial Literacy | Comprehensive education on key financial concepts and practices. |

| Community Support | Access to a platform for peer support, predominantly via Telegram. |

| Expert Sessions | Opportunities to learn from credit professionals in Q&A sessions. |

Exploring the Benefits

The framework of the program promises to offer holistic learning across various dimensions. The first element the focus on credit repair strategies aims at empowering participants by equipping them with the know-how to rectify issues related to their credit. This critical knowledge can be life-changing, reminiscent of finding the right map for an uncharted journey.

The second feature, credit card stacking, introduces an advanced technique that not everyone is familiar with but can reap enormous benefits if executed correctly. This strategy allows participants to leverage multiple credit cards to improve their credit utilization an essential factor for credit scoring.

A Double-Edged Sword

However, the excitement surrounding these benefits often contrasts sharply with the reports of poor customer service. Herein lies the dual nature of the program; while it presents a rich tapestry of learning opportunities, the inconsistencies in participant experiences reflect the program’s need for well-structured support to match its ambitious goals.

The Importance of Customer Support

The Hoodrich Credit Mentorship Program’s success ultimately hinges upon not just the educational content it provides but also the customer support framework surrounding it. As with any service-oriented program, accessibility to help when participants face hurdles is paramount.

A Tangible Disappointment

Unfortunately, many participants have voiced dissatisfaction with customer service a vital component serving as the backbone of any mentorship program. The inadequacies in addressing concerns have overshadowed the advantages of the educational content, bringing into question the overall reliability of the mentorship.

- Delayed Responses: Numerous individuals reported lengthy delays in receiving assistance, leading to a prolonged sense of uncertainty when navigating complex credit issues.

- Inadequate Solutions: When support was rendered, it frequently fell short of expectations, leaving participants feeling unsupported in their financial journeys.

A Call to Action

These experiences highlight an area ripe for improvement within the program. Established companies often infuse robust customer support systems to maintain satisfaction and retention rates. Hoodrich could benefit from examining successful models to refine its service delivery, ensuring participants that their concerns will be valued and addressed promptly thereby fostering an environment conducive to learning and financial growth.

Weighing the Pros and Cons

As with any decision, potential participants must weigh the advantages against the challenges before diving into the Hoodrich Credit Mentorship Program. A careful consideration of personal goals and expectations is essential for making an informed choice.

Pros

- Educational Wealth: The program provides a rich database of credit repair methods and strategies pertinent to today’s financial climate.

- Community Aspects: The sense of togetherness via community platforms fosters collaborative learning, which can enhance retention and understanding.

Cons

- Customer Support Concerns: Reports of insufficient customer service may discourage some individuals from fully engaging with the program.

- Variable Outcomes: Given the mixed experiences, individual results can vary greatly, with potential participants needing to evaluate their learning styles and support requirements.

Conclusion

In a world where financial literacy can serve as a fundamental cornerstone for personal and familial stability, programs like the Hoodrich Credit Mentorship offer promising avenues of learning and growth. With its focus on credit repair strategies and building a supportive community, the program positions itself as a valuable resource for many. However, the divergent experiences shared by participants, especially regarding customer support and resource accessibility, underline the necessity for potential enrollees to approach the program with caution. By carefully weighing their options and aligning their expectations with what the Hoodrich Credit Mentorship can realistically deliver, individuals can make empowered decisions that pave the way for financial success.

In the end, while the journey of credit management may be fraught with challenges, it is also one teeming with opportunities to grow, learn, and thrive. The choice lies in each individual’s hands, encouraging them to find the path that best suits their aspirations and needs.

Frequently Asked Questions:

Innovation in Business Models: We use a group purchase approach that enables users to split expenses and get discounted access to well-liked courses. Despite worries regarding distribution strategies from content creators, this strategy helps people with low incomes.

Legal Aspects to Take into Account: Our operations’ legality entails several intricate considerations. There are no explicit resale restrictions mentioned at the time of purchase, even though we do not have the course developers’ express consent to redistribute their content. This uncertainty gives us the chance to offer reasonably priced instructional materials.

Quality Control: We make certain that every course resource we buy is the exact same as what the authors themselves provide. It’s crucial to realize, nevertheless, that we are not authorized suppliers. Therefore, the following are not included in our offerings: – Live coaching sessions or calls with the course author.

– Entry to groups or portals that are only available to authors.

– Participation in closed forums.

– Straightforward email assistance from the writer or their group.

Our goal is to lower the barrier to education by providing these courses on our own, without the official channels’ premium services. We value your comprehension of our distinct methodology.

Be the first to review “HOODRICH CREDIT MENTORSHIP” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.