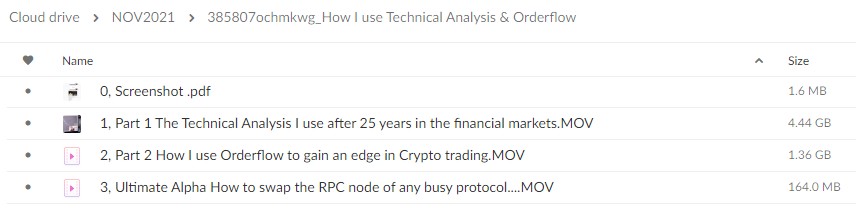

How I use Technical Analysis And Orderflow By Adam Webb – Traderskew

$300,00 $54,00

How I use Technical Analysis And Orderflow By Adam Webb – Traderskew – Instant Download!

Description:

How I use Technical Analysis And Orderflow By Adam Webb – Traderskew

How I use Technical Analysis & Orderflow

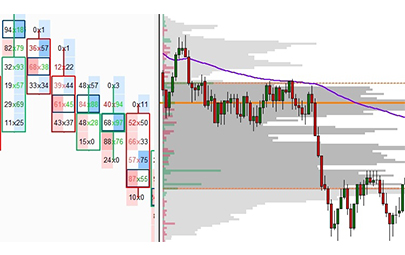

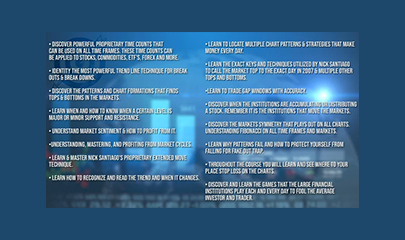

After 25 years of institutional trading experience. I have consolidated down what works for me, and how you can apply this to Crypto. I cover all my key Technical Analysis systems and an in-depth look into Orderflow & how to profit from it.

Adam Webb Biography

Mr. Webb is Trading Principal & Chief Investment Officer at Blue Creek Capital Management LLC. Mr. Webb was listed as a principal on 18th August 2020 and became a registered person of Blue Creek Capital Management LLC on 20th August 2020.

Mr. Webb has a 1st class degree in Economics and Maths from The London School of Economics (LSE) and a 1st class degree in Computer Science from The Nottingham University (NU). Mr. Webb started his career in May 1993 working for the Hull Trading Company, Inc. based in London on the LIFFE Exchange floor as an assistant trader, looking for arbitrage opportunities in various assets between London, Frankfurt and Chicago.

Mr. Webb moved to Goldman Sachs Group, Inc. in September 1999 as part of the Hull Trading Company acquisition . As an associate director for Over the Counter (OTC) Currency Options. Mr. Webb was responsible for the JPY, GBP and DEM Options desk until February 2001. Mr. Webb moved to Goldman Sachs Group, Inc, Tokyo in March 2001 to be the Director of Exotic Japanese Yen Currency Options. This role was split between time spent in Tokyo & London. Mr. Webb grew the Exotic desk to the largest interbank desk in Yen Options globally and saw profits rise 220% during 2001-2004. He held this position until July 2004.

Mr. Webb started his own family fund in September 2004. This business was focused on electronic market making Crude Oil Options on the NYMEX and IPE exchanges (Now CME & ICE). Mr. Webb’s deep awareness of the technical advances enabled this business to thrive. Mr. Webb simultaneously set up a technology company in September 2004, this was focused purely as a low-latency technology company in the fiber and microwave space. Mr. Webb privately sold this company in September 2010 (Mr. Webb retained 100% of the shareholding until the time of sale).

In Jan 2014 Mr. Webb established a consulting business (Closed November 2019) , to assist liquidity provision organizations with their Option price modelling and order-routing challenges between exchanges.

In January 2019 Mr. Webb co-founded Macrohedged, a small global macro research company focused purely on the Options on Futures markets looking for opportunities in Option Skewness and relative value strategies. This platform has proved widely popular and forms an ongoing source of alpha in the commodities and fixed income arena.

Mr. Webb held seats on the NYMEX exchange and CME IMM from 2004.

Mr. Webb is a Commodity Trading Advisor (CTA) registered with the CFTC and a member of the National Futures Association (0486265).

Mr. Webb has operated profitably as an independent market maker and fund operator since 2004, adapting and embracing new technology. Applying changes to models and market conditions. The last few years though, Mr. Webb has noticed a decline in profitability in the market making arena and focused on alpha extraction from skewness and relative value strategies. It is this area that shows a greater opportunity moving forwards.

Tags: How I use Technical Analysis & Orderflow By Adam Webb – Traderskew, How I use Technical Analysis & Orderflow By Adam Webb – Traderskew

Frequently Asked Questions:

1. Innovative Business Model:

- Embrace the reality of a genuine business! Our strategy involves orchestrating a group purchase, wherein we collectively distribute costs among members. Utilizing these pooled funds, we acquire in-demand courses from sales pages and make them accessible to individuals facing financial constraints. Despite potential reservations from the original authors, our customers value the affordability and accessibility we offer.

2. The Legal Landscape: Yes and No:

- The legality of our operations resides in a gray area. While we lack explicit approval from course authors for resale, a legal nuance comes into play. During the course acquisition, the author did not specify any restrictions on resale. This legal intricacy presents both an opportunity for us and a benefit for those seeking budget-friendly access.

3. Quality Assurance: Revealing the Real Deal:

- Delving into the core of the matter – quality. Procuring the course directly from the sales page ensures that all documents and materials are identical to those obtained through conventional means. However, our differentiator lies in going beyond individual study; we take an extra step by facilitating resale. It’s crucial to note that we are not the official course providers, which means certain premium services are not included in our package:

- No coaching calls or scheduled sessions with the author.

- No access to the author’s private Facebook group or web portal.

- No entry to the author’s exclusive membership forum.

- No direct email support from the author or their team.

We operate independently, aiming to bridge the affordability gap without the additional services offered by official course channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “How I use Technical Analysis And Orderflow By Adam Webb – Traderskew” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Options Trading with Nick And Gareth By Nick Santiago And Gareth Soloway – InTheMoneyStocks

Reviews

There are no reviews yet.