Mastering Technical Analysis by Investi Share

$997,00 $23,00

Mastering Technical Analysis by InvestiShare Review – Digital Download!

Let’s embark on a thrilling journey to uncover extraordinary insights that ignite your curiosity and transform your understanding

Mastering Technical Analysis by Investi Share

Overview

Mastering Technical Analysis by InvestiShare Review

In an age where data-driven decisions reign supreme, the importance of mastering technical analysis cannot be overstated. Enter InvestiShare a platform designed for traders seeking to sharpen their analytical skills and navigate the complexities of financial markets with confidence. Just as a skilled artist carefully selects their brushes for painting a masterpiece, traders must equip themselves with the right tools to interpret and act upon market data effectively. InvestiShare stands out as a guiding compass, illuminating the path toward informed trading practices through its comprehensive suite of features and resources.

Imagine stepping into a vast library filled with resources. Some sections overflow with advanced charts and indicators designed for seasoned analysts, while others break down the fundamentals for newcomers. InvestiShare embodies this concept by providing a user-friendly environment that caters to traders at every level. The platform not only facilitates the analysis of market trends but also fosters learning through supportive educational materials. Like a nurturing mentor, InvestiShare equips its users with the necessary knowledge to transform mere observations into actionable insights. This review will navigate through the myriad features and advantages of InvestiShare, showcasing its unique approach to mastering technical analysis.

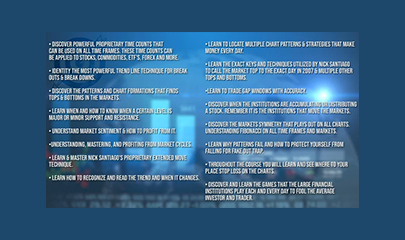

Key Features of InvestiShare

InvestiShare has emerged as a prominent player in the realm of trading platforms, offering an array of features meticulously tailored to enhance user experience. When we consider the versatility of InvestiShare in comparison to other tools, several standout qualities elevate it:

- Real-Time Data Analysis: The platform provides users with live market data, crucial for making timely and informed trading decisions. Trailing behind in the fast-paced financial environment is not an option, and InvestiShare ensures that users have their fingers on the market’s pulse.

- Advanced Charting Tools: InvestiShare boasts a wide variety of charting options line, bar, and candlestick charts allowing traders to visualize historical price movements effectively. This presents an organized method for decoding market trends, much like interpreting a novel through its chapters.

- Customizable Technical Indicators: With various customizable indicators at their disposal, traders can tailor their analyses to align with their trading strategies. This flexibility is akin to an artist selecting colors that best express their vision on canvas.

- User-Friendly Interface: Designed with simplicity in mind, the platform elevates the experience for both beginners and experienced traders alike. Navigating the software becomes seamless, providing ample opportunities to focus on executing trades rather than deciphering a complex interface.

- Educational Resources and Support: InvestiShare’s commitment to education is reflected through a plethora of resources including tutorials, webinars, and live support. These materials are integral for traders eager to enhance their understanding of technical analysis concepts and improve their trading strategies.

- Market Sentiment Analysis: InvestiShare prompts traders to assess market mood through sentiment analysis. This aspect encapsulates the intangible elements influencing market movement, allowing for more informed predictions.

Collectively, these features equip users with the essential tools needed for strategic trading, ultimately enabling them to navigate the complexities of financial markets with confidence and insight.

Real-Time Data Analysis

In the realm of trading, having accurate and timely information can be likened to possessing a treasure map; without it, risks of miscalculation loom large. InvestiShare signifies a crucial ally, offering real-time data analysis that profoundly impacts investment decisions.

- Live Market Data: Traders are granted access to live streaming data, ensuring no information is lost when market changes occur. This immediacy serves as a pivotal edge in capitalizing on fleeting opportunities.

- Dynamic Market Assessment: Through real-time observations, traders can adapt their strategies promptly, shifting gears as market sentiment fluctuates. For instance, swift changes in stock prices can compel traders to act within seconds to avoid missing out on potential profits.

- Historical Comparisons: By analyzing past patterns alongside real-time data, traders are better equipped to predict future movements. This dual approach allows for more nuanced and informed decision-making.

- Impact on Trading Decisions: The ability to view continuous data updates transforms the approach to trading, instilling confidence as decisions are informed by current conditions rather than outdated information.

In summary, real-time data analysis offered by InvestiShare is the heartbeat of informed trading. It empowers traders to act swiftly, minimizing negative impacts caused by delays and enhancing overall strategy execution.

Advanced Charting Tools

Understanding the nuances of market behavior entails a proficient command of advanced charting tools, and InvestiShare excels in this domain. The platform presents a sophisticated suite conducive to detailed analytics, breaking down market dynamics effectively.

- Diverse Charting Options: Users can harness the power of various chart types, including candlestick, bar, and line charts, to analyze market trends from multiple perspectives. Each charting style provides unique insights while complementing one another.

- Customization Capabilities: Traders can tailor timeframes and indicators used in their charts, allowing for personalized analysis that aligns with individual strategies an essential feature that underscores the adaptable nature of the platform.

- Technical Pattern Recognition: Advanced charting tools enable traders to identify key patterns such as head and shoulders, triangles, and double tops. Recognizing these patterns can signal potential price reversals, arming traders with foresight to maximize their profitability.

- Drawing and Annotation Features: Incorporating drawing tools aids users in visualizing key support and resistance levels. Adding notes or marking trend lines fosters a proactive approach to navigating market fluctuations.

Through these advanced charting capabilities, InvestiShare transitions the complexity of market volatility into a structured analysis, allowing traders to focus on building strategies that maximize their investment potential.

Customizable Technical Indicators

Equipping oneself with customizable technical indicators is essential for traders looking to refine their analysis and improve decision-making processes. InvestiShare integrates these tools seamlessly, enabling users to tailor their trading experiences.

- Versatile Indicator Selection: Users have access to a broad range of indicators such as moving averages, MACD, and RSI. Each indicator serves a specific function, aiding in identifying entry and exit points based on historical price data.

- Flexible Settings: Traders can customize indicator settings according to their strategies. This personalization empowers them to create an analytical framework that suits their market outlook, enhancing precision in trading activities.

- Synergy of Indicators: Combining multiple indicators facilitates a comprehensive market assessment. This layered analysis helps traders to validate signals, ensuring that decisions are based on multifaceted insights rather than singular indicators.

- Educational Guidance: InvestiShare provides educational resources on the effective use of these indicators. Successful utilization translates theoretical knowledge into practical outcomes, paving the way for informed strategy development.

- User-Friendly Application: Intuitive navigation ensures that the application of indicators remains accessible, regardless of users’ prior experience. This ease of use reduces barriers, allowing traders to focus on developing robust analysis rather than confronting technological challenges.

The provision of customizable technical indicators places InvestiShare at the forefront of technical analysis, offering an adaptable and empowering resource for traders to elevate their strategies.

User-Friendly Interface

Navigating a trading platform should be as fluid as water flowing through a brook seamless and without obstruction. InvestiShare’s user-friendly interface exemplifies this ideal, making advanced trading analytics available to both novice and experienced traders.

- Intuitive Design: InvestiShare’s layout is thoughtfully structured to facilitate ease of navigation. New users can quickly familiarize themselves with essential tools without feeling overwhelmed, while seasoned traders appreciate the streamlined functionality.

- Accessibility Features: Quick access menus to frequently used tools enhance usability, minimizing the amount of time spent hunting for features. Traders can dive right into their analyses, optimizing their trading time.

- Supportive Design Elements: Color-coded charts and an organized dashboard reduce cognitive overload. Visual clarity enables traders to focus on interpreting information rather than deciphering what each component signifies.

- Responsive Support: The platform includes support functionality, such as live chat or FAQs, which proves invaluable during trading hours. Prompt assistance ensures that traders can continue their activities without significant interruptions.

By prioritizing user experience, InvestiShare empowers traders to focus on strategic decisions, fostering an enriching environment where learning and analysis thrive.

Educational Resources and Support

InvestiShare recognizes that the key to successful trading lies not just in the tools at hand but in the knowledge acquired through education. Therefore, the platform offers extensive resources designed to cater to various learning needs.

- Comprehensive Learning Modules: InvestiShare’s educational offerings cover a broad range of topics from introductory aspects of technical analysis to nuanced trading strategies, ensuring that users have access to valuable insights regardless of their experience level.

- Interactive Resources: Webinars, tutorials, and community discussions provide interactive learning experiences that foster engagement. Traders are encouraged to connect with industry experts and one another, exchanging knowledge that enhances comprehension.

- Continuous Improvement: InvestiShare provides ongoing updates to educational content, reflecting market changes and new trends. This commitment to relevancy keeps traders informed and ready to adapt strategies to fluctuating conditions.

- Community Engagement: Their platform supports networking and collaboration among users, building a shared learning atmosphere that encourages growth and skill enhancement.

By prioritizing education and continuous support, InvestiShare fosters a community of informed traders equipped to thrive in a competitive environment.

Core Concepts of Technical Analysis

At the heart of InvestiShare’s offerings lies an understanding of the fundamental concepts of technical analysis. Recognizing these core elements is vital for traders aiming to interpret market dynamics effectively.

- Price Action Analysis: The movement of prices over time forms the basis of technical analysis. Traders study these fluctuations to identify potential trends and reversals, guiding their decision-making processes.

- Trends and Patterns: Recognizing market trends whether upward, downward, or sideways is crucial as decisions are generally more rewarding when aligned with prevailing market momentum.

- Support and Resistance: Key prices where market reversals frequently occur, these levels assist traders in determining potential buy and sell points, serving as a roadmap in trading decisions.

- Volume Analysis: The amount of trading activity often reinforces price movements, where high volume signals strong trends. Understanding how volume interacts with price provides invaluable insights into market strength.

- Technical Indicators: Various indicators assist in assessing market conditions, enhancing analysis when combined with other data points.

Grasping these core concepts imbues traders with the confidence to navigate the complex landscape of financial markets. InvestiShare effectively bridges knowledge gaps through educational content designed for profound understanding and application.

Understanding Charts and Graphs

A trader’s ability to analyze charts and graphs underpins their capability to forecast future market behavior. InvestiShare provides resources that empower users to decipher these visual aids skillfully.

- Candlestick Patterns: Familiarity with various patterns, such as doji and engulfing candles, can signal potential reversal points, serving as vital indicators for entry and exit strategies.

- Trend Lines: Drawing trend lines on charts enables traders to visualize price momentum and establish where the market may be heading. Analyzing price movements against these lines can yield valuable insights.

- Chart Types Selection: The choice between line, bar, or candlestick charts plays a pivotal role in analysis. Each type offers distinct perspectives on price movements, enhancing the trader’s ability to interpret market behavior.

- Overlaying Indicators: Advanced charting platforms allow users to overlay indicators on their charts, enriching analyses and reinforcing decision-making frameworks based on comprehensive insights.

- Momentum Tracking: Charts serve as tools for monitoring momentum, with indicators providing supplementary data to validate observations. Understanding how to read momentum indicators can assist traders in optimizing strategies.

In essence, mastering the art of reading charts and graphs lays the foundation for advanced technical analysis. InvestiShare equips traders with the necessary tools and knowledge to interpret these visual assets effectively.

Importance of Technical Indicators

Navigating the world of trading without technical indicators is akin to sailing without a compass directionless and fraught with uncertainty. InvestiShare emphasizes the significance of these tools in deciphering market movements and making informed decisions.

- Signal Generation: Indicators such as moving averages inform traders of potential entry and exit points, allowing for more calculated risk-taking.

- Trend Confirmation: Technical indicators validate the direction of price movements. For instance, an upward crossover of the moving averages might signal a buy opportunity, solidifying belief in market direction.

- Market Sentiment Reflection: Indicators gauge trader psychology, with high volume and specific patterns hinting at strong interest. Understanding market sentiment enhances predictive capabilities and informs strategy formulation.

- Noise Filtering: By stripping away extraneous data, indicators allow traders to focus on meaningful price movements ideal for maintaining clarity in volatile environments.

- Automated Trading Compatibility: The quantitative nature of indicators makes them suitable for automated trading strategies, where trades are executed based on algorithmic parameters without emotional bias.

Mastering technical indicators equips traders with critical tools to assess market conditions and refine their strategies, ultimately helping them to thrive within competitive financial landscapes.

Market Trends and Sentiment

InvestiShare extends its services beyond data analysis; it provides insights into market trends and sentiment, essential factors influencing trading success.

- Trend Analysis: Understanding whether the market is in an uptrend, downtrend, or range-bound activity is vital for aligning trading strategies accordingly.

- Supply and Demand Influence: Market prices pivot on supply and demand dynamics, which traders can analyze through price movements and historical data points. Recognizing these shifts assists in anticipating market behavior.

- Historical Patterns: Traders leverage historical data to discern prevailing patterns that may predict future market behavior, reinforcing the principle that history often repeats itself.

- Volume as a Confirmation Tool: Volume trends enhance the robustness of price movement analyses. An increase in volume during a price surge can signify strong market conviction, solidifying potential trade decisions.

- Psychological Factors: Market psychology determines how traders react to price movements. Tools like the Fear and Greed Index help traders gauge market sentiment, allowing for informed assessments amid volatility.

Through the analysis of market trends and sentiment, InvestiShare equips traders to make prudent, strategic decisions that enhance their trading success.

Practical Applications of InvestiShare

InvestiShare’s efficacy in technical analysis translates into multiple practical applications that empower traders during various stages of their investment journey.

Setting Up Your First Analysis

- Understanding Basic Principles: The platform begins by instilling foundational knowledge in technical analysis, preparing traders for the journeys ahead.

- Utilizing TradingView: InvestiShare highlights the importance of using TradingView for creating watchlists and customizing trading dashboards. Familiarity with these tools is crucial for effective execution.

- Identifying Key Patterns: Training emphasizes recognizing significant market patterns, such as support and resistance levels, which inform trading strategy.

- Applying Technical Indicators: Practical sessions utilizing indicators like RSI and MACD are designed for immediate application, transforming theory into actionable insight.

- Practice Simulations: InvestiShare asserts the importance of practice; simulated environments allow traders to apply their skills without financial risks, reinforcing theoretical lessons through lived experiences.

Through structured learning pathways, InvestiShare equips newcomers with the necessary skills to build confidence and establish effective trading strategies.

Advanced Features for Market Prediction

InvestiShare facilitates sophisticated analyses through advanced features tailored for enhancing market prediction capabilities.

- Data Analysis Techniques: Access to both historical and real-time data empowers traders to analyze fluctuations and identify potential opportunities.

- Advanced Charting Techniques: The platform incorporates various charting techniques essential for developing market insights, including trend visualization through candlestick charts.

- Indicator Mastery: Training encompasses the versatility of indicators such as Moving Averages and RSI, guiding traders in spotting market momentum.

- Correlation Insight: Traders explore correlations between markets, enhancing predictive accuracy through intermarket analysis.

- Simulation Workshops: Practical workshops emphasize traders’ ability to simulate trades based on backtesting outcomes, refining their strategies as they gain hands-on experience.

Overall, these advanced features position InvestiShare as a formidable resource for traders aiming to deepen their market understanding and predictive prowess.

Backtesting Strategies

A compelling feature of InvestiShare is its ability to streamline the backtesting of trading strategies, an invaluable resource for refining strategies before risking actual capital.

- Applying Historical Data: Traders can implement established strategies on historical data to evaluate effectiveness, discovering potential pitfalls without financial consequences.

- Scenario Simulations: With tools that facilitate the simulation of diverse trading environments, users can adjust parameters to understand how varying conditions influence outcomes.

- Performance Analysis: Good strategies are actionable and measurable; thus, traders receive performance metrics from backtested strategies, providing insight into hit ratios and drawdown levels.

- Interactive Learning: Practical workshops entrench users in real-world scenarios, helping them build the confidence necessary for successful trading.

- Iterative Refinement: The opportunity to continuously refine strategies through backtesting ultimately heightens traders’ prospects for success in live market conditions.

By offering these features, InvestiShare cultivates a proactive community geared toward sustainable trading growth.

Comparing InvestiShare to Other Tools

When evaluating the unique attributes of InvestiShare against other trading tools, several advantages become evident, reinforcing its position within the industry.

- Personalized Learning Experience: In contrast to competitors, InvestiShare curates its content based on individual skill sets, ensuring that users receive instruction tailored to their respective levels as opposed to the one-size-fits-all approach prevalent among many platforms.

- Robust Community Engagement: InvestiShare fosters a collaborative environment through interactive webinars and live Q&A sessions, contributing to a unique learning experience that many competitors lack.

- Real-Time Simulation Environment: The platform equips users to practice skills in a risk-free simulation setting, which is a rare find among competitors. This feature instills confidence and reduces the psychological barriers associated with live trading.

- Continuous Content Updates: Unlike platforms that present static information, InvestiShare updates its course materials in alignment with ever-evolving market data and trends. This agility ensures traders have access to the most relevant information.

- Competitive Pricing Structures: InvestiShare offers a variety of pricing tiers, amplifying access to their resources and catering to a broader audience compared to competitors that impose higher fees.

Through these distinguishing factors, InvestiShare positions itself as a valuable resource for those dedicated to mastering the nuances of technical analysis.

Advantages Over Competitors

InvestiShare holds various advantages over its competitors, shaping it as a compelling choice for traders focused on amplifying their analytical capacities.

- Comprehensive Educational Framework: Users experience a structured, step-by-step learning pathway that incorporates both foundational and advanced concepts, enhancing the educational journey. Comparatively, many competitors fail to provide such thorough immersion.

- Adaptive Learning Approach: InvestiShare tailors its course materials to user needs, enabling personalized learning paths. This approach contrasts starkly with platforms offering generalized content, thereby enriching the learning experience.

- Active Community Interaction: The consistent emphasis on community engagement promotes collaborative learning. Users bond over shared motivations and challenges, fostering a supportive network often absent within other platforms.

- Hands-On Simulations: The integration of risk-free market simulations offers users a taste of real trading conditions, allowing them to practice strategies. This prepares traders for practical applications simpler than those seen in many competitors.

- Strong User Feedback: Testimonials frequently highlight positive outcomes associated with InvestiShare, such as improved trading performance and strategic execution. The efficacy of its educational offerings is consistently underscored by real-world results.

These advantages collectively position InvestiShare as a formidable ally for traders yearning to enhance their technical analysis skills.

Limitations and Considerations

While InvestiShare excels in various aspects, potential users should consider undercurrents that may influence their experience with the platform.

- Internet Dependency: Given its reliance on continuous internet connectivity, any interruptions could hinder access to real-time data, potentially impacting timely trading decisions. This could be a significant drawback for day traders or those in volatile markets.

- Complexity for Beginners: While InvestiShare caters to all experience levels, the abundance of advanced tools may overwhelm newcomers. Beginners may require additional support to navigate intricate functionalities effectively.

- Cost Considerations: InvestiShare’s pricing model may be higher than competitors that provide simpler functionalities, compelling users to weigh the depth of features against costs.

- Focus on U.S. Markets: Primarily tailored to the U.S. markets, traders seeking global insights may find limits in data accessibility, restricting broader asset diversification.

These considerations warrant careful evaluation as prospective users weigh the benefits of InvestiShare against their own trading goals and environmental needs.

User Experience and Interface Design

A seamless user experience is essential in the complex landscape of trading platforms, and InvestiShare dedicates significant effort to ensuring intuitive design.

- Navigational Simplicity: The interface’s clarity promotes straightforward navigation, allowing traders to focus on analysis rather than grappling with technological conundrums.

- Visual Hierarchy and Structure: Key features are displayed prominently and logically sequenced, minimizing cognitive overhead and enabling users to access tools efficiently.

- Customization Opportunities: Users can tailor the interface by adjusting settings per their preferences. This personal touch decreases clutter and enhances comfort, facilitating better trading experiences.

- Community Engagement Features: InvestiShare seamlessly integrates community resources, fostering engagement through user-led discussions that enrich the overall learning ambiance.

- Interactive Design Elements: With responsive search functionality and quick access to essential tools, users experience fluid interaction, fostering a sense of empowerment throughout the trading process.

Through its commitment to user experience and interface design, InvestiShare cultivates an environment that transcends mere functionality empowering traders to focus on holistic decision-making.

Navigation and Usability

Navigation and usability form the backbone of a successful trading experience. InvestiShare’s commitment to these aspects ensures that users can effortlessly interface with crucial features.

- Consistent Navigation Elements: The platform aims for consistent user navigation, reducing confusion when moving between tools. This consistency fosters a smooth transition, leading to more confident analytical decisions.

- Clear Labeling: Investments in clarity through clearly labeled menus and features provide users with an intuitive comprehension of available tools and their purposes.

- Visual Importance: Employing visual hierarchy enhances user experiences. Color-coded elements highlight actionable features while less important elements recede, creating clarity in navigational choices.

- User Control and Freedom: By allowing for easy backtracking and recovery from navigational errors, users experience a sense of control, nurturing a positive emotional connection with the platform.

- Systems Feedback: Users receive immediate feedback regarding their actions, confirming successful requests and guiding future interactions seamlessly.

This focus on navigation and usability ultimately cultivates an experience that empowers traders to feel more comfortable and confident in their interactions.

Customization Options

InvestiShare’s flexibility extends to robust customization options, fostering an enhanced experience for users as they engage with the platform.

- Tailored Experiences: Users can adjust appearances and settings to cater to their preferences, leading to individualized experiences that enhance satisfaction and usability.

- Shortcut Features: Integrating shortcuts for frequently used tools streamlines workflows for experienced traders, catering to varying preferences while preserving simplicity for beginners.

- Enhanced Dashboard Arrangement: The ability to save settings and reorganize dashboards enriches the user experience, empowering traders to tailor their environments to improve functional interactions.

- Context-Sensitive Suggestions: The platform employs algorithms to deliver suggested adjustments based on user activity, enhancing relevance and boosting efficiency.

- Feedback Mechanisms: Any customization actions are acknowledged, presenting confirmation that modifications have been saved, which reinforces user control over their interface.

By promoting personalization, InvestiShare creates an engaging environment that resonates with trader preferences, ultimately supporting a more immersive trading experience.

Learning and Development Opportunities

InvestiShare champions continuous learning and development opportunities, positioning itself as a resource for traders looking to evolve their skills and knowledge.

- Structured Learning Framework: The platform offers a comprehensive curriculum that spans essential concepts and advanced trading strategies, ensuring depth and breadth in learning.

- Accessible Resources: Users enjoy ongoing access to webinars, tutorials, and instructional materials, charting a clear path for skill enhancement while balancing convenience and depth.

- Active Community Support: The collective wealth of knowledge available within InvestiShare’s community encourages continued engagement, fostering collaboration and mentorship opportunities.

- Evolving Educational Content: With regular updates on contemporary market trends and innovations, users are equipped with pertinent information that primes them for ongoing industry changes.

- Networking and Collaboration: Opportunities for interaction through community forums and discussion platforms allow users to share insights and experiences, further enriching their educational journeys.

Through its robust commitment to learning and development, InvestiShare empowers traders to continuously evolve, ensuring relevance and adaptability within a fast-paced environment.

Educational Resources Available

The educational resources at InvestiShare provide an essential foundation for traders seeking to deepen their technical analysis knowledge and understanding.

- Comprehensive Curriculum: InvestiShare’s offerings cover a spectrum of relevant topics, ensuring all levels of traders can access content that resonates with their current knowledge base and aspirations.

- Interactive Learning Environment: Through webinars, Q&A sessions, and community engagement, users derive collective insights that facilitate understanding and practical application of complex topics.

- On-Demand Tutorials: Packed with visual aids, these tutorials are designed to be accessible anytime, catering to varying learning styles while providing immediate clarification of key concepts.

- Real-World Examples: The educational content connects theoretical concepts to practical applications, reinforcing learning through case studies that mirror actual market scenarios.

- Engagement and Growth: The community-driven aspect of education fosters a supportive atmosphere where users are encouraged to share knowledge and encourage one another in their learning journeys.

By focusing heavily on educational resources, InvestiShare imbues traders with the knowledge necessary to cultivate their skills and strategies successfully.

Community and Support Networks

A strong community and support network can significantly enhance a trader’s learning experience, and InvestiShare underlines this aspect with commitment and purpose.

- Interactive Discussion Forums: Users can engage in vibrant discussion spaces that foster collaboration, share strategies, and seek advice from peers with varied experiences.

- Mentorship Opportunities: Informal mentorship is fostered through community connections, allowing newcomers to learn directly from seasoned traders an invaluable resource for skill development.

- Resource Exchange: Community members often share valuable insights, research, and tools that assist one another in crafting effective trading strategies, promoting a spirit of collaboration.

- Workshops and Trainings: Frequent workshops and live sessions offer users opportunities to engage with expert traders, gaining tailored insights into their specific challenges.

- Supportive Learning Atmosphere: The collaborative culture nurtures confidence and motivation, encouraging users to persist in their learning endeavors as they exchange and grow collectively.

Through its emphasis on community and support networks, InvestiShare establishes itself as more than just a platform; it becomes a collaborative environment where traders can thrive together.

Conclusion: Value for Traders

In the competitive world of trading, the Mastering Technical Analysis course by InvestiShare emerges as a transformative resource, equipping traders with the knowledge and tools essential for navigating the complexities of the financial landscape.

- Comprehensive Training: The course structure provides in-depth coverage of both fundamental and advanced technical analysis concepts, ensuring even novices gain a robust understanding.

- Practical Application Focus: With an emphasis on real-world applications and market simulations, users are empowered to translate knowledge into practice effectively, significantly enhancing confidence.

- Community Engagement: The lively community activity creates a sense of belonging, enabling traders to learn from one another while fostering collaboration key elements that enhance the learning journey.

- Ongoing Education Opportunity: InvestiShare ensures adaptability in its education through continuous updates and support, keeping traders equipped for an evolving market.

- Valuable Investment: The multifaceted approach enhances trading performance, making InvestiShare’s offerings a valuable investment for those committed to honing their skills.

In summation, with its nuanced educational framework and community-centric philosophy, InvestiShare emerges as an invaluable ally for traders aiming to master technical analysis. Its dedication to equipping users with the necessary tools and knowledge ultimately fosters a generation of savvy traders prepared to tackle the challenges within the financial markets.

Overall Effectiveness and Benefits

The effectiveness of InvestiShare reverberates through user feedback demonstrating notable improvements in trading strategies and outcomes. By providing sophisticated analytical tools, continuous education, and communal support:

- Enhanced Trading Performance: Participants consistently report enhanced confidence leading to successful trades, a reflection of InvestiShare’s effective educational strategies.

- Structured Learning Pathways: The well-organized curriculum ensures that learners have an immersive journey, solidifying concepts that translate directly into actionable trading decisions.

- User Accessibility and Engagement: A focus on user experience ensures that all features remain accessible, enabling a diverse array of traders to engage deeply without feeling intimidated.

- Transformational Learning Environment: Through ongoing engagement and mentorship, users develop not just skills but also a lasting network of support, boosting their overall trading efficacy.

- Sustaining Learning Opportunities: InvestiShare’s commitment to evolving educational resources prepares traders for long-term success in a changing financial landscape.

This powerful combination of effectiveness and user-focused strategies positions InvestiShare as a leader in trading education, emphasizing the importance of mastering technical analysis for long-term trading success.

Target Audience and Suitability

InvestiShare’s offerings cater to a wide range of audiences, establishing it as a suitable choice for individuals committed to expanding their trading knowledge:

- Novice Traders: Beginners seeking foundational knowledge will appreciate the comprehensive introduction to technical analysis, making the learning process engaging and insightful.

- Intermediate Traders: These individuals can build upon existing skills, leveraging advanced strategies to enhance their trading performance in a supportive environment.

- Professional Traders: Even seasoned traders can find value in the continuous education offered, particularly in the adaptation of strategies that reflect current market trends.

By acknowledging the diverse needs and aspirations of its users, InvestiShare fosters an environment that empowers traders throughout their entire growth journey.

This review of Mastering Technical Analysis by InvestiShare encapsulates the platform’s unwavering commitment to empowering traders through education, advanced technical tools, and community support. Whether one is just starting their journey in trading or looking to sharpen existing skills, InvestiShare provides an invaluable toolkit to navigate the complexities of this fast-paced world.

Frequently Asked Questions:

Innovation in Business Models: We use a group purchase approach that enables users to split expenses and get discounted access to well-liked courses. Despite worries regarding distribution strategies from content creators, this strategy helps people with low incomes.

Legal Aspects to Take into Account: Our operations’ legality entails several intricate considerations. There are no explicit resale restrictions mentioned at the time of purchase, even though we do not have the course developers’ express consent to redistribute their content. This uncertainty gives us the chance to offer reasonably priced instructional materials.

Quality Control: We make certain that every course resource we buy is the exact same as what the authors themselves provide. It’s crucial to realize, nevertheless, that we are not authorized suppliers. Therefore, the following are not included in our offerings: – Live coaching sessions or calls with the course author.

– Entry to groups or portals that are only available to authors.

– Participation in closed forums.

– Straightforward email assistance from the writer or their group.

Our goal is to lower the barrier to education by providing these courses on our own, without the official channels’ premium services. We value your comprehension of our distinct methodology.

Be the first to review “Mastering Technical Analysis by Investi Share” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action By Aiman Almansoori

Forex Trading

Forex Trading

Options Trading with Nick And Gareth By Nick Santiago And Gareth Soloway – InTheMoneyStocks

Core Financial Modeling 2024 By Breaking Into Wall Street

Core Financial Modeling 2024 By Breaking Into Wall Street

Reviews

There are no reviews yet.