-

×

Licensing Secrets By Ken Kerr

1 × $23,00

Licensing Secrets By Ken Kerr

1 × $23,00

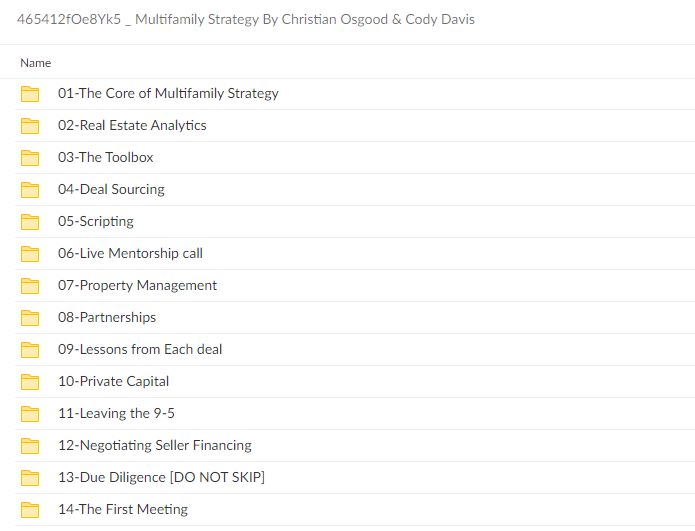

Multifamily Strategy By Christian Osgood & Cody Davis

$1.499,00 $15,00

Multifamily Strategy: A Deep Dive into Innovative Real Estate Investing – Digital Download!

Let’s embark on a captivating adventure to uncover remarkable insights that spark your curiosity and elevate your understanding

Multifamily Strategy By Christian Osgood & Cody Davis

Overview

A Comprehensive Look at Cutting-Edge Real Estate Investing with Multifamily Strategy

Multifamily properties have gradually become a more well-known and profitable specialty in the real estate investing industry. The need for housing, scalability, and cash flow all combine to create an atmosphere that is favorable for investment. The creators of the “multifamily strategy” platform, Christian Osgood and Cody Davis, have created a method that is not only successful but also revolutionary for prospective investors. These two thought leaders, whose backgrounds are different but united by a common goal, have developed a mentorship program that enables people to successfully negotiate the challenges of multifamily real estate. Their experience, which focuses on coaching and special financing techniques, offers prospective investors who are keen to get into the multifamily market a road map.

The Origins of Multifamily Strategy

Christian Osgood started his real estate investing career with the specific objective of earning $15,000 a month. This goal is incredibly ambitious, like a sailor setting off on a journey to a far-off island. Through unwavering perseverance, Christian not only achieved this goal but also closed five agreements in a short 11-month period. This achievement demonstrates the value of concentration and the efficacy of well-informed real estate decision-making.

Over the course of his three-year adventure, Osgood accumulated an outstanding 350 units in his portfolio. Without a mastery of multifamily investment methods and an innovative approach to financing—like a maestro conducting a complicated symphony of opportunities—this quick expansion would not have been feasible. Each unit serves as a foundation for wealth generation and financial freedom rather than merely being a piece of real estate. For individuals who think that significant riches may be attained through wise real estate investments, Christian’s story is motivational and a lighthouse.

Co-founder of the platform and seasoned creative finance professional Cody Davis started his journey at the young age of 19. He used seller finance to buy a $1.1 million property as his first real estate venture. This decision demonstrates the significant influence that innovative financing choices can have on an investor’s career path. Cody’s choices highlight strategies for overcoming financial obstacles and taking advantage of profitable chances, much like finding a secret route through a dense forest. His early success isn’t just a coincidence; it shows how successful using creative strategies is when buying multifamily real estate.

The Method: Instruction and Guidance

Osgood and Davis’s multifamily approach is based on a dedication to mentoring and education. They think that in the realm of real estate investing, information is the actual currency. They have given many people the skills they need to thrive despite having little money by sharing their knowledge through organized programs.

Among the instructional materials offered by their mentorship is a thorough rundown of the fundamental ideas of multifamily investing. These include knowing the ins and outs of property management as well as cash flow dynamics. The goal of the mentorship program is to create a community of investors who can assist one another and exchange techniques and experiences, rather than just conducting transactions. This sensation of belonging is strong because it creates a collaborative atmosphere that is similar to a bustling marketplace where opportunities and ideas are shared.

Their lessons place a strong emphasis on innovative finance strategies including private capital and seller financing. These tactics aim to remove the obstacles that frequently keep prospective investors from joining the market. For example, seller financing turns sellers into investment partners by enabling purchasers to get beyond conventional loan barriers. It’s similar to dancing in which both people move in unison to achieve a same objective. By demonstrating how successful these tactics are, Christian and Cody have shown that anyone with the correct information and perseverance can succeed in real estate; success is not limited to people with large sums of money.

The participants’ stated favorable results provide as additional evidence of the effectiveness of their strategy. Numerous people have successfully put the program’s principles into practice, which has changed their financial situation.

Key Strategies Within Multifamily Investing

The multifamily strategy hinges on several innovative approaches that redefine traditional investment paradigms. Below is a summary of key strategies that Osgood and Davis advocate:

1. Creative Financing Techniques

- Seller Financing: Allows buyers to finance the purchase directly through the seller, bypassing banks and traditional financing routes.

- Private Lending: Engaging friends, family, or private investors to fund a purchase, which can often have more flexible terms compared to conventional loans.

2. Value-Add Strategies

- Renovations: Improving properties to increase their value and rental income potential. This can include anything from cosmetic upgrades to major renovations.

- Operational Efficiency: Streamlining property management processes to reduce expenses and enhance profitability.

3. Building a Robust Network

- Mentorship: Partnering with experienced investors to gain insights and guidance.

- Networking Opportunities: Joining real estate investment groups to connect with like-minded individuals, share experiences, and discover potential deals.

4. Long-Term Investment Mindset

- Market Research: Understanding evolving market trends to identify growth opportunities.

- Sustainability: Investing in areas poised for long-term growth rather than chasing quick returns.

5. Exit Strategies

- Refinancing: Leveraging increased equity to fund new investments while holding onto profitable properties.

- Selling: Timing the market to maximize profits on property sales.

These strategies, while straightforward in their presentation, carry depths of knowledge that can significantly impact an investor’s success trajectory. By tailoring approaches to fit individual circumstances, Osgood and Davis exemplify the notion that no two investors are alike, and strategies must adapt to personal goals and market conditions.

The Impact of Multifamily Strategy

The multifamily strategy not only provides a pathway for individual success but also contributes positively to community dynamics. When investors acquire multifamily properties, they assume a role akin to community stewards, focused on improving living conditions while concurrently building their wealth. This role comes with responsibility; the impact of effective property management and renovation extends far beyond financial gains.

Rehabilitated properties often lead to revitalized neighborhoods, which can foster a sense of pride and boost local economies. Improved properties typically attract better tenants, which decreases turnover rates and enhances community stability. This reciprocal relationship between investor and community is symbiotic, facilitating an uplifting of standards and quality of life.

As Osgood and Davis continue to share their insights through podcasts, mentorship, and educational content, the ripple effect of their impact spreads. They have created a movement that transcends mere property ownership to emphasize the importance of fostering environments where people can thrive. Investing in multifamily properties is about more than just financial returns; it is about nurturing communities that, in turn, nurture their inhabitants.

In conclusion

To sum up, Christian Osgood and Cody Davis co-founded the multifamily strategy platform, which offers a fresh and all-encompassing method of real estate investing. They enable prospective investors to realize their objectives without being constrained by financial limitations by combining training, mentoring, and innovative funding techniques. Their individual experiences make for gripping tales that encourage others to follow their own routes to financial independence in the multifamily industry.

The ideas and insights offered by Osgood and Davis are still applicable and significant even as the real estate market changes. Regardless of your level of experience, applying the multifamily investment principles can result in significant decisions and life-changing outcomes. Building a satisfying life through financial independence, rejuvenating communities, and leaving enduring legacies are all important aspects of the multifamily strategy journey.

Frequently Asked Questions:

Innovation in Business Models: We use a group purchase approach that enables users to split expenses and get discounted access to well-liked courses. Despite worries regarding distribution strategies from content creators, this strategy helps people with low incomes.

Legal Aspects to Take into Account: Our operations’ legality entails several intricate considerations. There are no explicit resale restrictions mentioned at the time of purchase, even though we do not have the course developers’ express consent to redistribute their content. This uncertainty gives us the chance to offer reasonably priced instructional materials.

Quality Control: We make certain that every course resource we buy is the exact same as what the authors themselves provide. It’s crucial to realize, nevertheless, that we are not authorized suppliers. Therefore, the following are not included in our offerings: – Live coaching sessions or calls with the course author.

– Entry to groups or portals that are only available to authors.

– Participation in closed forums.

– Straightforward email assistance from the writer or their group.

Our goal is to lower the barrier to education by providing these courses on our own, without the official channels’ premium services. We value your comprehension of our distinct methodology.

Be the first to review “Multifamily Strategy By Christian Osgood & Cody Davis” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.