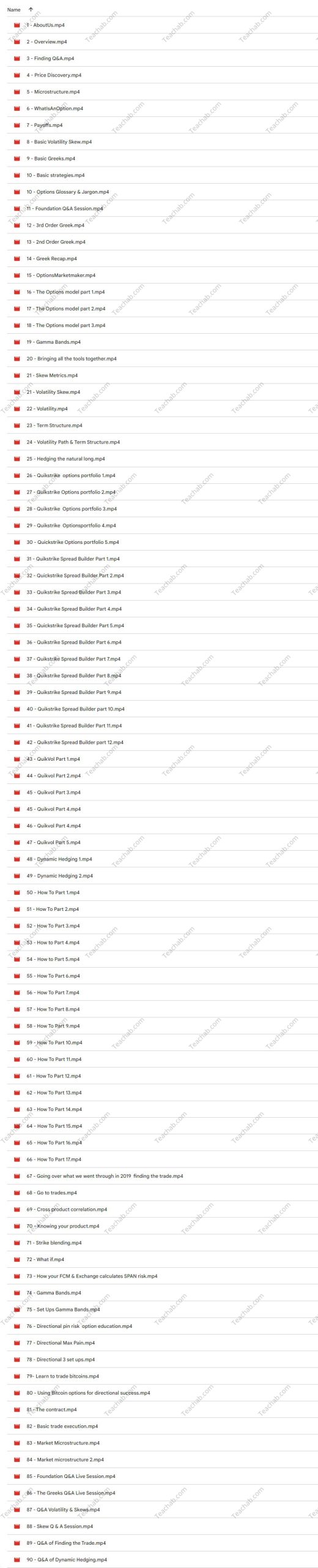

Options Education FULL Course 30+ Hours By Macrohedged

$900,00 $23,00

Options Education FULL Course 30+ Hours By Macrohedged – Download Now!

Description:

Options Education FULL Course 30+ Hours By Macrohedged

FULL 5 DAY COURSE SPEC

Foundation Day

- Price.

- Market microstructure.

- The Options on Futures market.

- The CME, EUREX & ICE – Why they are different and who futures exchanges operate.

- The Greeks (1st Order Greeks).

- Option Value Calculation.

- Knowing your position and how it will change.

- Glossary & Jargon.

- Setting up the right tools for the week.

Objective is to get everyone on the foundation day fully prepared to learn at a greater depth for the rest of the week

4 Day DeepDive

- Spreads & Strategies

- The Models (B&S, Binomial Trees)

- The Market Maker – Their role, your role

- Volatility

- Skew (RR, BF and path trading)

- Trading Volatility & Skew

- Dynamic hedging

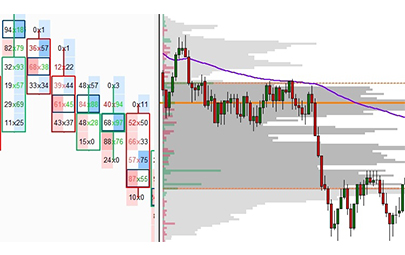

- Position risk

- Greeks in depth

- 2nd Order Greeks (Vomma, Charm, Vera,Dvega, DeltaTime)

- 3rd Order Greeks (Color, Speed, Ultima, Zomma)

- Option sensitivity

- Position sensitivity

- Cross Greeks & Correlation sensitivity

- Trading Skew

- The Volatility Surface

- Volatility diffusion

- Dynamic Replication and Jump diffusion

- Bringing all the tools together

- How to run an Options portfolio

- Cross asset risk management

- Finding the trade, looking for value.

- Understanding the CME’s rules on option and postion margin

- Understanding how your FCM calculates span risk to meet CFTC obligations.

- What if planning and modelling

At the end of this intensive four days, you will understand all the variable that can change the price of an option and thus the implications on your portfolio. You will understand the role of the exchange, the market maker and the FCM. You will be able to manage cross asset risks, model complex ‘what if’ scenarios and learn how to look for value in the options on futures world.

Tags: Options Education FULL Course 30+ Hours By Macrohedged, Options Education FULL Course 30+ Hours By Macrohedged, Options Education FULL Course 30+ Hours By Macrohedged

Frequently Asked Questions:

1. Innovative Business Model:

- Embrace the reality of a genuine business! Our strategy involves orchestrating a group purchase, wherein we collectively distribute costs among members. Utilizing these pooled funds, we acquire in-demand courses from sales pages and make them accessible to individuals facing financial constraints. Despite potential reservations from the original authors, our customers value the affordability and accessibility we offer.

2. The Legal Landscape: Yes and No:

- The legality of our operations resides in a gray area. While we lack explicit approval from course authors for resale, a legal nuance comes into play. During the course acquisition, the author did not specify any restrictions on resale. This legal intricacy presents both an opportunity for us and a benefit for those seeking budget-friendly access.

3. Quality Assurance: Revealing the Real Deal:

- Delving into the core of the matter – quality. Procuring the course directly from the sales page ensures that all documents and materials are identical to those obtained through conventional means. However, our differentiator lies in going beyond individual study; we take an extra step by facilitating resale. It’s crucial to note that we are not the official course providers, which means certain premium services are not included in our package:

- No coaching calls or scheduled sessions with the author.

- No access to the author’s private Facebook group or web portal.

- No entry to the author’s exclusive membership forum.

- No direct email support from the author or their team.

We operate independently, aiming to bridge the affordability gap without the additional services offered by official course channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Options Education FULL Course 30+ Hours By Macrohedged” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

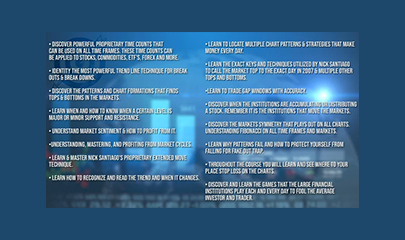

Options Trading with Nick And Gareth By Nick Santiago And Gareth Soloway – InTheMoneyStocks

7 Figure Sales Training and Script Bundle By Eric Cline

7 Figure Sales Training and Script Bundle By Eric Cline

Reviews

There are no reviews yet.