-

×

Secrets of a Winning Trader By Gareth Soloway

1 × $871,00

Secrets of a Winning Trader By Gareth Soloway

1 × $871,00 -

×

Pattern Design- From Hand to Screen to Surface By Molly Hatch

1 × $5,00

Pattern Design- From Hand to Screen to Surface By Molly Hatch

1 × $5,00 -

×

Wired For Weight Loss By Mark Patrick

1 × $23,00

Wired For Weight Loss By Mark Patrick

1 × $23,00

The Indices Orderflow Masterclass By The Forex Scalpers

$450,00 $23,00

SKU: KOB.553326k56S1

Category: Forex Trading

Tags: Masterclass, Orderflow, The Forex Scalpers, The Indices Orderflow Masterclass

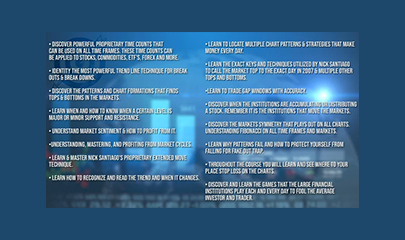

Review of The Indices Orderflow Masterclass by The Forex Scalpers – Instant Download!

Let’s embark on a captivating adventure to uncover remarkable insights that spark your curiosity and elevate your understanding

The Indices Orderflow Masterclass By The Forex Scalpers

Overview

‘Review of The Indices Orderflow Masterclass by The Forex Scalpers

For anyone navigating the tumultuous waters of forex trading, understanding the intricacies of the market can feel akin to plotting a course through a stormy sea. The Forex Scalper’s Indices Orderflow Masterclass offers a sanctuary of knowledge, illuminating the path for traders at all experience levels. In this masterclass, a comprehensive educational experience awaits that meticulously details the nuances of scalping and order flow analysis. It stands out as a beacon for both novices seeking foundational knowledge and seasoned traders desiring to refine their expertise. This educational journey promises to open doors to new insights that could potentially transform trading strategies.

Foundational Knowledge: Building Blocks of Forex Trading

The inception of any trading journey often begins with a solid foundation. In the realm of forex trading, this foundational knowledge is not just important it’s essential. The masterclass lays out critical principles and terminology that define the forex landscape. Imagine embarking on a journey without understanding the compass; such is the fate of a trader venturing into forex without sufficient foundational knowledge.

The course strategically covers the basics, ensuring that even a novice can grasp core concepts without feeling overwhelmed. For example, terms such as pips, leverage, and spread are clearly defined, accompanied by illustrations to demystify their implications on trading. The importance of having this knowledge base cannot be overstated it serves as the bedrock upon which traders can build their skills, enabling them to tackle more complex strategies later on.

Moreover, the structured learning approach ensures that the information flows logically, creating an intellectual scaffold that supports detailed understanding. As traders progress from understanding the basic concepts to mastering intricate strategies, the course cultivates a sense of confidence and competence that is often lacking in the early stages of trading.

Focus on Scalping: Strategies for Quick Trades

The rapid pace of scalping characterized by executing multiple trades to capture small price movements demands precision and agility. This course delves deep into this fast-paced trading style, illuminating the path for those eager to adopt scalping as their preferred strategy. Imagine a sprinter poised at the starting block this is how a successful scalper must approach each trade, ready to spring into action at a moment’s notice.

The lesson plans include step-by-step strategies that empower participants to excel in scalping. From identifying the right entry and exit points to understanding market volatility, every aspect is dissected with surgical precision. For instance, a key takeaway is the importance of choosing correlated pairs to maximize potential profit while minimizing risk. This strategic aspect, coupled with an awareness of economic indicators, equips scalpers with the tools necessary to stay ahead in a dynamic market.

Additionally, the course showcases real-world examples of successful scalping trades, illustrating how minor fluctuations can yield significant profits when executed effectively. With an emphasis on maintaining a disciplined trading mindset, scalpers learn to navigate their emotional responses to market movements turning the potential chaos of the market into a structured, manageable endeavor.

In-depth Order Flow Analysis: Understanding Market Sentiment

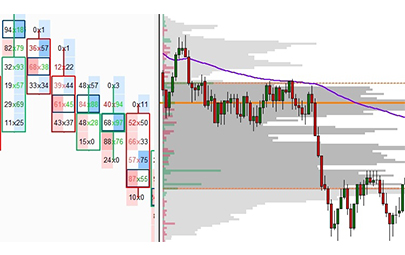

What sets the Forex Scalper’s Indices Orderflow Masterclass apart is its distinctive focus on order flow analysis. This advanced technique delves into the real-time flow of buy and sell orders, offering traders a lens through which they can discern market sentiment. Instead of relying solely on traditional indicators, traders can develop a more intuitive understanding of market dynamics a skill akin to tuning an instrument to the subtle vibrations of music.

Order flow analysis allows traders to make decisions rooted in the actual behavior of other market participants. By understanding where the bulk of buy and sell orders are clustered, traders can anticipate potential price movements. The course provides practical tools such as market profile and point of control (POC), which help in identifying areas of value. These advanced concepts enhance the trader’s ability to make informed decisions, turning abstract data into actionable insights.

Here, participants engage in hands-on exercises that reinforce their learning. For instance, they analyze real-time data to identify trends and potential reversals in the market, transforming theoretical concepts into practical skills. This blend of knowledge and application becomes a powerful tool, allowing traders to navigate the complexities of forex with greater assurance.

Advanced Tools and Techniques: Elevating Trading Strategies

In the competitive world of forex trading, having the right tools can mean the difference between success and failure. The masterclass introduces participants to a suite of advanced trading tools that can elevate their trading strategies to new heights. Just as a craftsman relies on a well-stocked toolbox, a trader benefits immensely from having access to sophisticated instruments that enhance their analysis.

The inclusion of tools such as Market Profile and Point of Control (POC) enables traders to visualize market structure and determine value areas. Understanding where price consolidation occurs can help traders make more informed decisions about when to enter or exit positions. The program takes strategies a step further by integrating these tools into practical trading scenarios, thereby solidifying participants’ command over their trading pursuits.

Additionally, the curriculum encourages participants to experiment with these tools within simulated environments. This aspect of practical application not only enhances learning but also builds confidence, empowering traders to approach real markets with assuredness and skill. The marriage of advanced tools and hands-on application lays a solid groundwork for successful trading strategies.

Practical Application: Bridging Theory and Execution

Theory in trading is vital, but without practical application, it remains just that a theory. This masterclass understands that the true test of any trading strategy lies in its execution. Therefore, it offers numerous opportunities for participants to engage in hands-on experiences, including simulated trading exercises and live trading sessions. This dual approach ensures that learning transcends the classroom, transforming knowledge into actionable skills.

Each module is designed to include practical applications that reinforce theoretical concepts. Traders engage in real-time scenarios where they apply what they have learned about scalping and order flow analysis. For example, they may participate in trading simulations that mimic actual market conditions, thereby experiencing the thrill and challenges of live trading without financial risk. This experiential learning helps to instill confidence and prepares participants to transition smoothly into real trading environments.

Equally important, traders are encouraged to reflect on their experiences, fostering an ongoing culture of learning and adaptation. This self-assessment approach allows them to identify strengths and areas for improvement, further refining their trading techniques. It’s a reminder that in the fast-paced world of trading, continuous learning is not just beneficial it is crucial for long-term success.

Risk Management: Safeguarding Trading Capital

In the world of trading, risk is inherent, but it is how traders manage that risk that determines their longevity and success. The Forex Scalper’s Indices Orderflow Masterclass pays particular attention to this aspect, providing valuable insights into effective risk management strategies tailored for the scalping style. Here, the importance of having a robust risk management plan is akin to a life preserver in turbulent waters essential for safeguarding one’s trading capital.

Participants learn techniques for setting stop-loss levels, which are crucial in protecting against excessive losses during rapid market movements. The course delves into calculating position sizes based on account capital and volatility, guiding participants on how to maintain a balanced approach to risk. This knowledge empowers traders to develop personalized risk mitigation strategies that align with their trading objectives and risk tolerance.

Moreover, a significant aspect of risk management discussed in the course is the importance of emotional control. A scalper’s decisions are often made under high-pressure conditions, and maintaining composure becomes paramount. By equipping traders with techniques to manage their psychological responses, the course emphasizes that successful trading is as much about emotional intelligence as it is about technical skill.

Psychological Insights: Mastering the Mental Game

While technical skills and strategies are critical, the psychological aspects of trading can often dictate success or failure. Understanding one’s emotions and maintaining discipline are essential qualities for a successful trader especially in the high-stakes environment of scalping. The masterclass addresses these psychological dimensions, providing participants with valuable insights into managing stress and anxiety.

The course emphasizes the necessity of adhering to trading plans and strategies even when emotional impulses urge traders to deviate. For example, sudden market shifts can provoke feelings of uncertainty, leading to hasty decisions. To combat this, the curriculum incorporates techniques for maintaining focus and composure, helping traders remain grounded amidst market chaos.

Furthermore, participants are encouraged to share their experiences and emotions, fostering a supportive community where traders can learn from one another. This communal approach can alleviate feelings of isolation that traders often experience and provides an opportunity for collective growth. Ultimately, the masterclass cultivates a complete trader, one who possesses not just technical knowledge but also the mental fortitude to execute trades effectively.

Conclusion: Transformative Journey for Traders

In essence, the Forex Scalper’s Indices Orderflow Masterclass serves as a transformative journey for aspiring and seasoned traders alike. With its meticulous blend of foundational knowledge, advanced strategies, and practical application, the course equips participants with the necessary tools to navigate the complexities of the forex market effectively.

As traders step into this educational sanctuary, they are met with a wealth of insights designed to sharpen their skills and elevate their trading prowess. With a keen focus on risk management and psychological resilience, this masterclass prepares traders for the unpredictable nature of the forex landscape. For those committed to enhancing their trading skills and expanding their market understanding, this course stands as a valuable resource a guiding star in the vast sky of opportunities that forex trading offers.

For traders willing to invest their time and effort, this masterclass promises not just knowledge but the potential for profound personal and professional growth in their trading journey.

Frequently Asked Questions:

Innovation in Business Models: We use a group purchase approach that enables users to split expenses and get discounted access to well-liked courses. Despite worries regarding distribution strategies from content creators, this strategy helps people with low incomes.

Legal Aspects to Take into Account: Our operations’ legality entails several intricate considerations. There are no explicit resale restrictions mentioned at the time of purchase, even though we do not have the course developers’ express consent to redistribute their content. This uncertainty gives us the chance to offer reasonably priced instructional materials.

Quality Control: We make certain that every course resource we buy is the exact same as what the authors themselves provide. It’s crucial to realize, nevertheless, that we are not authorized suppliers. Therefore, the following are not included in our offerings: – Live coaching sessions or calls with the course author.

– Entry to groups or portals that are only available to authors.

– Participation in closed forums.

– Straightforward email assistance from the writer or their group.

Our goal is to lower the barrier to education by providing these courses on our own, without the official channels’ premium services. We value your comprehension of our distinct methodology.

Be the first to review “The Indices Orderflow Masterclass By The Forex Scalpers” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Options Trading with Nick And Gareth By Nick Santiago And Gareth Soloway – InTheMoneyStocks

Reviews

There are no reviews yet.