-

×

Training Session - Self Defense by Renzo Gracie

1 × $6,00

Training Session - Self Defense by Renzo Gracie

1 × $6,00 -

×

Icebreaker ZERO - Personalize your Outreach at UNLIMITED Scale By Kevin Sozanski

1 × $46,00

Icebreaker ZERO - Personalize your Outreach at UNLIMITED Scale By Kevin Sozanski

1 × $46,00 -

×

The Full Package 8 Courses By Inthemoneystocks

1 × $443,00

The Full Package 8 Courses By Inthemoneystocks

1 × $443,00 -

×

The Methodology Revealed By Nick Santiago And Gareth Soloway - InTheMoneyStocks

1 × $209,00

The Methodology Revealed By Nick Santiago And Gareth Soloway - InTheMoneyStocks

1 × $209,00 -

×

7 Figure Sales Training and Script Bundle By Eric Cline

1 × $319,00

7 Figure Sales Training and Script Bundle By Eric Cline

1 × $319,00 -

×

RMF ISSO Foundations Course By Bruce Brown

1 × $62,00

RMF ISSO Foundations Course By Bruce Brown

1 × $62,00 -

×

Clear Xing Yi Quan - Clear Martial Arts By Richard Clear

1 × $155,00

Clear Xing Yi Quan - Clear Martial Arts By Richard Clear

1 × $155,00 -

×

Product Alliance Full Library Access Pass By Product Alliance

1 × $202,00

Product Alliance Full Library Access Pass By Product Alliance

1 × $202,00 -

×

Learn the Unity 3D Shuriken Particle System By Stone River eLearning

1 × $6,00

Learn the Unity 3D Shuriken Particle System By Stone River eLearning

1 × $6,00 -

×

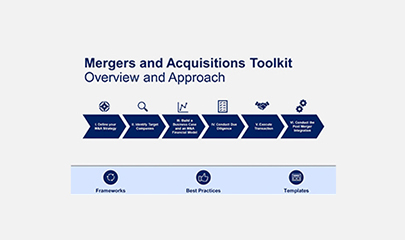

Mergers and Acquisitions Toolkit By Domont Consulting

1 × $23,00

Mergers and Acquisitions Toolkit By Domont Consulting

1 × $23,00

Volatility Trading PDF By Fractal Flow Pro

$198,00 $8,00

SKU: KOB.50620EsE7FW

Category: Forex Trading

Tags: Fractal Flow Pro, Trading, Volatility Trading PDF

Review of Volatility Trading PDF by Fractal Flow Pro – Digital Download!

Let’s embark on a captivating adventure to uncover remarkable insights that spark your curiosity and elevate your understanding

Volatility Trading PDF By Fractal Flow Pro

Overview

Review of Volatility Trading PDF by Fractal Flow Pro

Navigating the capricious waters of the financial markets requires more than just intuition; it calls for a deep understanding of the tools and strategies available to traders. The volatility trading PDF by Fractal Flow Pro offers a treasure trove of insights aimed at both novice and experienced traders alike. It dives deep into the intricate dance of market volatility, highlighting crucial types that influence trading decisions, namely realized, implied, and expected volatility. By unveiling the fractal flow strategy a systematic approach merging market trends, fractal patterns, and momentum divergences this document not only educates but also equips traders with the necessary tools to seize opportunities when market conditions fluctuate.

Understanding Volatility in Trading

The Nature of Volatility

Volatility, in the realm of finance, refers to the degree of variation in trading prices over a certain period. It can be visualized as the wild waves of the ocean, sometimes calm and serene, while at other times, it crashes violently against the shore. Understanding the different forms of volatility is akin to becoming a seasoned sailor who knows when to steer into the storm and when to hold steady.

- Realized Volatility: This is a historical measure, capturing how much the price of an asset has fluctuated in the past. Analyzing realized volatility can provide insights into price patterns that may repeat.

- Implied Volatility: Derived from the prices of options, implied volatility acts as a forecast of likely price fluctuations in the future. Investors often view high implied volatility as a signal of potential price swings.

- Expected Volatility: This is a more anticipatory measure, often calculated using statistical methods to predict future price fluctuations based on current market conditions.

The Importance of Understanding Volatility

A trader’s ability to discern these types of volatility plays a significant role in crafting successful strategies. For instance, recognizing the confluence of high implied volatility with a significant market event can motivate a trader to position themselves advantageously, akin to setting a fishing net in a bountiful tide. This understanding becomes particularly crucial when implementing the fractal flow strategy, which hinges on identifying opportunities created through these waves of volatility.

Traders who neglect the nuances of volatility may find themselves floundering, caught in the riptides of unexpected market shifts. Therefore, Fundamentos capacita (fundamental knowledge) about how markets behave cyclically opens doors to informed, strategic decision-making.

Fractal Flow Strategy: A Pathway to Trading Success

Overview of the Fractal Flow Strategy

At its core, the fractal flow strategy integrates timeless market principles with modern trading techniques. By examining both the fractal nature of market movements and the principles of momentum divergences, traders can spot conditions ripe for profitable trades.

- Fractal Patterns: These are recurring forms defined by self-similarity across different time scales. Recognizing these patterns can give traders a leading edge in forecasting market movements.

- Momentum Divergences: This concept focuses on contrasting price movements with underlying momentum indicators, providing clues about potential reversals or continuation.

The beauty of fractals lies in their complexity and simplicity; they embrace the unpredictability of nature while providing a structured approach to market analysis. In this sense, traders function as artists, painting their strategies upon the canvas of ever-shifting market conditions.

Implementing the Strategy

To implement the fractal flow strategy effectively, traders must follow a systematic approach. This often includes:

- Identifying Fractal Patterns: Utilizing charting tools to observe recurring price movements that indicate potential buy or sell signals.

- Monitoring Momentum Indicators: Using oscillators like RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence) to gauge market momentum and detect divergences.

- Contextual Analysis: Combining insights from realized and implied volatility to make informed trading decisions.

By marrying these analytical techniques, traders can create a robust framework that harnesses market volatility rather than succumbing to it.

Practical Applications of Volatility Trading Strategies

Tools and Resources

In addition to the theoretical frameworks, the volatility trading PDF by Fractal Flow Pro provides practical tools and guidelines for traders. Access to resources can be intrinsic to honing one’s craft in the volatile trading environment. Below is a list of valuable tools and resources recommended:

- Charting Platforms: Software such as TradingView or MetaTrader enables real-time analysis of price movements and identification of fractal patterns.

- Volatility Indicators: Tools like the Average True Range (ATR) or Bollinger Bands can help measure volatility and potential price targets.

- Educational Courses: Many platforms offer comprehensive courses designed around volatility trading, which can supplement the PDF content.

Each of these elements contributes to a trader’s arsenal, allowing them to navigate the currents of volatility confidently.

Risk Management

Nevertheless, with great opportunity comes great risk. Effective trading strategies must incorporate sound risk management practices. This includes:

- Setting Stop-Loss Orders: This automated process of limiting losses on trades is crucial to protect capital.

- Position Sizing: Determining how much of a portfolio to allocate to a particular trade can influence long-term success.

- Continuous Learning: The financial landscape is ever-evolving, and traders should remain committed to ongoing education regarding market dynamics, economic indicators, and innovative trading strategies.

In essence, robust risk management presents a lifeboat in the unpredictable sea of trading, guiding traders toward long-term sustainability amidst inevitable volatility.

Conclusion

The volatility trading PDF by Fractal Flow Pro is more than just a compilation of strategies; it is a calling to embrace the mysteries of the financial markets with an informed perspective. By understanding the different types of volatility and effectively employing the fractal flow strategy, traders can rise above the chaotic waves of the market, making informed decisions that lead to profitable opportunities. Whether you’re sailing into the storm or riding the calm waves, mastery over volatility is essential for thriving in the world of trading. As you embark on this journey, remember the tools and principles outlined in this guide, and let them be your compass to navigate the volatile seas ahead.

Frequently Asked Questions:

Innovation in Business Models: We use a group purchase approach that enables users to split expenses and get discounted access to well-liked courses. Despite worries regarding distribution strategies from content creators, this strategy helps people with low incomes.

Legal Aspects to Take into Account: Our operations’ legality entails several intricate considerations. There are no explicit resale restrictions mentioned at the time of purchase, even though we do not have the course developers’ express consent to redistribute their content. This uncertainty gives us the chance to offer reasonably priced instructional materials.

Quality Control: We make certain that every course resource we buy is the exact same as what the authors themselves provide. It’s crucial to realize, nevertheless, that we are not authorized suppliers. Therefore, the following are not included in our offerings: – Live coaching sessions or calls with the course author.

– Entry to groups or portals that are only available to authors.

– Participation in closed forums.

– Straightforward email assistance from the writer or their group.

Our goal is to lower the barrier to education by providing these courses on our own, without the official channels’ premium services. We value your comprehension of our distinct methodology.

Be the first to review “Volatility Trading PDF By Fractal Flow Pro” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Options Trading with Nick And Gareth By Nick Santiago And Gareth Soloway – InTheMoneyStocks

Reviews

There are no reviews yet.