-

×

BASS DROPS SOUND FX By Ocular Sounds

1 × $4,00

BASS DROPS SOUND FX By Ocular Sounds

1 × $4,00

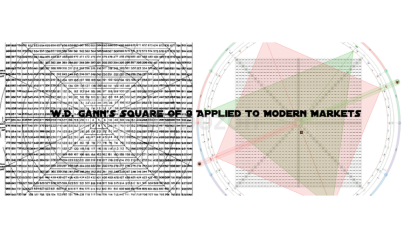

W D Gann Square Of 9 Applied To Modern Markets By Sean Avidar – Hexatrade350

$139,00 $23,00

SKU: KOB.56619mF4hj1

Category: Forex Trading

Tags: Hexatrade350, Modern Markets, Sean Avidar, Square Of 9, W D Gann Square Of 9 Applied To Modern Markets

W.D. Gann’s Square of 9 Applied to Modern Markets – Immediate Download!

Let’s embark on a captivating adventure to uncover remarkable insights that spark your curiosity and elevate your understanding

W D Gann Square Of 9 Applied To Modern Markets By Sean Avidar – Hexatrade350

Overview

W.D. Gann’s Square of 9 Applied to Modern Markets

The evolving landscape of finance continually beckons traders to seek strategies that stand the test of time. In such an intricate maze of numbers and fluctuations, W.D. Gann’s Square of 9, as meticulously outlined by Sean Avidar, emerges not just as a relic of trading history but as a robust navigational chart for modern markets. This work bridges the gap between Gann’s complex theories and their immediate applicability in today’s rapidly shifting financial environment. Avidar’s book serves as a beacon for both novice and seasoned traders, offering enlightening insights into Gann’s methodologies while demonstrating their relevance in contemporary trading scenarios.

Understanding Gann’s Square of 9

The Structure of the Square

At its core, the Gann Square of 9 is a geometric tool that organizes numbers in a unique spiral pattern an elegant dance of mathematics that reveals the potentialities of the market. Imagine stepping onto a chessboard, where each move can be calculated not just by existing pieces but by the very essence of numerical relationships that govern the market realm. By placing numbers in a clockwise spiral, Gann created a visual and functional framework that highlights important relationships between price, time, and market direction.

Interpreting Price and Time

What makes Gann’s Square of 9 captivating is its ability to connect seemingly unrelated elements: price and time. Thought of as a compass, this square allows traders to perceive the ebb and flow of market dynamics more clearly. For example, Gann theorized that significant price movements often synchronize with specific time intervals week, month, or even minute. As Avidar articulates, the relationships observed in the square can assist traders in discerning support and resistance levels, essential for executing trades wisely.

To aid comprehension, consider the layout:

- The square’s arrangement allows traders to pinpoint key price levels.

- By applying simple arithmetic operations, significant turning points in the market can be forecasted.

- Angles derived from the square can direct traders to potential peaks and troughs within their strategy.

Practical Applications Across Markets

Avidar shines a light on the square’s versatility, illustrating its applicability across various market types be it stocks, commodities, or options. Traders can derive actionable insights by correlating Gann’s numerical constructs with real-time trading data. The author emphasizes that this adaptability is what makes Gann’s methodologies not merely theoretical but deeply pragmatic.

In a table summarizing Avidar’s insights:

| Market Type | Application of Gann’s Square |

| Stocks | Identifying key entry/exit points based on angle relationships |

| Commodities | Forecasting price movements through time cycles |

| Options | Utilizing support/resistance levels for pricing strategies |

Whether viewing the stock ticker or analyzing commodity prices, the square provides a framework that champions the blending of quantitative analysis and instinctual trading.

Advanced Concepts of Gann Time Cycles and Angles

Gann Time Cycles Unveiled

Delving deeper, Avidar introduces readers to intricate concepts such as Gann Time Cycles. These cycles propose that identifiable patterns recur periodically, shaping the trajectory of market movements. Herein lies the essence of Gann’s brilliance; he highlighted that understanding time is as pivotal as understanding price. For instance, Avidar shares case studies demonstrating how cycles can alert traders to potential reversals or continuations, effectively enhancing predictive insights.

- Cycle Lengths: Traders can expect key market movements every 30, 90, or 180 days, providing a framework to anticipate shifts.

- Price Alignment: Gann theorized that price levels would harmonize with these time connections, offering further layers of strategy.

Utilizing Gann Angles in Strategy

Alongside time cycles, Avidar elaborates on Gann Angles tools that help ascertain potential entry or exit points. Visualizing these angles as even paths radiating from a central pivot enhances a trader’s ability to identify critical market movements. Each angle can signify specific price movements, acting as radar for a trader navigating tumultuous market waters.

For instance, consider the following Gann angles:

- 1×1 Angle: Represents a balance between price and time, often acting as a strong support or resistance.

- 2×1 Angle: Indicates price acceleration when this angle is broken, it can signal significant trends.

This unique intersection of price and time equips traders with a dynamic approach, enabling them to make more informed decisions rooted in Gann’s intricate methodologies.

Bridging Theory to Practice

Enhancing Trading Strategies

As Avidar’s work unfurls, a dual theme emerges the elegance of Gann’s theories paired with their practical use in modern trading. The book’s utility transcends mere academic interest; it empowers traders to incorporate these age-old principles into their everyday strategies. Avidar details actionable techniques for weaving Gann’s insights into technical analysis tools a synergistic approach that hones accuracy in trade execution.

- Traders can combine the square with indicators such as Moving Averages or RSI (Relative Strength Index).

- The added dimension of Gann analytics can refine entry points, boosting the likelihood of success.

The Learning Curve

However, Avidar candidly addresses the steep learning curve associated with Gann’s theories. For many, the perceived complexity can deter engagement. Yet, he advocates for persistence, illustrating through thorough explanations and illustrative examples that a deep understanding of these principles can yield substantial returns. He emphasizes, “Every expert was once a beginner,” encouraging readers to embrace the nuances embedded within Gann’s work.

The Broader Perspective

Ultimately, Avidar situates Gann’s methodologies within a larger financial context reminding traders that understanding market mechanics is an ongoing journey. Armed with the tools and concepts elucidated in this work, traders are better positioned to analyze market movements and trends dynamically. Gann’s analytical framework facilitates a holistic view of trading, illuminating that graphs and numbers are more than static points they represent the very pulse of market psychology.

Conclusion

In conclusion, W.D. Gann’s Square of 9 Applied to Modern Markets serves as a vital resource for traders seeking depth and direction amidst the chaos of financial markets. Sean Avidar has masterfully articulated Gann’s principles, breathing life into theories that resonate powerfully within today’s trading environments. Through detailed explanations, practical applications, and an empathetic recognition of the challenges traders face, Avidar empowers readers to navigate the financial seas with confidence. Those who are willing to engage deeply with Gann’s methodologies will undoubtedly find themselves not just trading but mastering the market landscape, armed with insights that are both timeless and timely.

Frequently Asked Questions:

Innovation in Business Models: We use a group purchase approach that enables users to split expenses and get discounted access to well-liked courses. Despite worries regarding distribution strategies from content creators, this strategy helps people with low incomes.

Legal Aspects to Take into Account: Our operations’ legality entails several intricate considerations. There are no explicit resale restrictions mentioned at the time of purchase, even though we do not have the course developers’ express consent to redistribute their content. This uncertainty gives us the chance to offer reasonably priced instructional materials.

Quality Control: We make certain that every course resource we buy is the exact same as what the authors themselves provide. It’s crucial to realize, nevertheless, that we are not authorized suppliers. Therefore, the following are not included in our offerings: – Live coaching sessions or calls with the course author.

– Entry to groups or portals that are only available to authors.

– Participation in closed forums.

– Straightforward email assistance from the writer or their group.

Our goal is to lower the barrier to education by providing these courses on our own, without the official channels’ premium services. We value your comprehension of our distinct methodology.

Be the first to review “W D Gann Square Of 9 Applied To Modern Markets By Sean Avidar – Hexatrade350” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Options Trading with Nick And Gareth By Nick Santiago And Gareth Soloway – InTheMoneyStocks

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action By Aiman Almansoori

Reviews

There are no reviews yet.