-

×

Bring Balance to Life and Purpose to Work By John Demartini

1 × $15,00

Bring Balance to Life and Purpose to Work By John Demartini

1 × $15,00 -

×

The Facebook Traffic Blueprint by Andy Skraga

1 × $5,00

The Facebook Traffic Blueprint by Andy Skraga

1 × $5,00 -

×

LOB Secret Treasure of Loving-Kindness: The Green Latifa - LB-GRE-EV By Diamond Approach

1 × $23,00

LOB Secret Treasure of Loving-Kindness: The Green Latifa - LB-GRE-EV By Diamond Approach

1 × $23,00 -

×

Scalp Trading Mini Course By Jayson Casper

1 × $23,00

Scalp Trading Mini Course By Jayson Casper

1 × $23,00 -

×

How I use Technical Analysis And Orderflow By Adam Webb - Traderskew

1 × $54,00

How I use Technical Analysis And Orderflow By Adam Webb - Traderskew

1 × $54,00 -

×

7 Powers Package By John Demartini

1 × $31,00

7 Powers Package By John Demartini

1 × $31,00 -

×

Options Academy Elevate By Simon Ree - Tao of Trading

1 × $109,00

Options Academy Elevate By Simon Ree - Tao of Trading

1 × $109,00 -

×

Conscious Cashflow Triad By Jesse Elder

1 × $101,00

Conscious Cashflow Triad By Jesse Elder

1 × $101,00

We Fund Traders – The Whale Order

$5,00

We Fund Traders – The Whale Order: A Comprehensive Review – Digital Download!

Let’s embark on a captivating adventure to uncover remarkable insights that spark your curiosity and elevate your understanding

We Fund Traders – The Whale Order

Overview

We Fund Traders – The Whale Order: A Comprehensive Review

In today’s competitive trading landscape, finding the right avenue to hone one’s skills and gain financial backing can feel akin to navigating a labyrinth without a map. That’s where We Fund Traders – The Whale Order comes into play, acting not just as a guiding light but as a robust community supporting aspiring traders. This proprietary trading firm has carved out a niche by marrying education with opportunity, creating a unique ecosystem for traders to flourish. If you’re an enthusiastic beginner or even a seasoned trader looking for a fresh start, this might just be the firm you’ve been searching for. Below, we delve deeply into the firm’s offerings, evaluating their impact and effectiveness, while also addressing key aspects that potential traders should consider.

Educational Features of We Fund Traders

One of the most striking aspects of We Fund Traders is its robust educational foundation. Education is the bedrock upon which successful trading careers are built, and this firm appears to understand that principle intimately. The company has designed a comprehensive training and mentorship program that connects aspiring traders with seasoned professionals across a diverse range of asset classes, including forex, stocks, and commodities.

The approach here isn’t just about disseminating information but rather crafting an immersive learning experience. For many new entrants, the world of trading can be overwhelming numerous strategies, market dynamics, and behavioral factors can throw even the most determined individual off course. However, We Fund Traders aims to transform this chaos into a structured learning journey. Participants engage in a series of lessons and hands-on projects that not only build their theoretical knowledge but also facilitate the practical application of those concepts in real-world trading scenarios.

Moreover, the mentorship aspect prepares traders for the unpredictable nature of the markets, instilling confidence and enhancing critical thinking. When participants have access to real-time feedback from knowledgeable mentors, they can refine their approaches and strategies without the high stakes of real capital at play. This kind of structured support is vital for those who may struggle in isolation. Research shows that community and mentorship are pivotal in enhancing trading performance, making We Fund Traders a beacon for aspiring traders.

Funding Opportunities for Aspiring Traders

After the training phase, We Fund Traders opens the door to their unique funding opportunities, but how does this work? Essentially, once traders successfully navigate the mentorship phase typically lasting several months they’re given the chance to trade using the firm’s capital. This setup, where traders can demonstrate their skills without putting their funds at risk, is particularly attractive for those who may hesitate to invest personal capital in the unpredictability of trading.

Funding Framework at We Fund Traders:

| Feature | Details |

| Profit Sharing | 50/50 profit-sharing arrangement |

| Demo Account Duration | Minimum of 3 months |

| Daily Loss Limit | 5% |

| Maximum Drawdown | 6% |

| Profit Target | 10% |

| Leverage | Up to 1:20 |

While the profit-sharing arrangement may seem somewhat modest compared to firms offering up to 90%, it strikes a balance that many traders find appealing. By retaining a 50% share, traders benefit from certainty, knowing they have a legitimate stake in the profits generated. The firm’s straightforward evaluation process consisting of just one step and lacking in complicated timeframes also enhances its attractiveness.

As traders demonstrate consistent profit potential, they can transition seamlessly into a funded account, ready to tackle larger positions and potentially larger profits. Additionally, the flexibility in holding positions over weekends is a thoughtful feature, allowing traders to adopt longer-term strategies without the fear of overnight risk accumulation.

Evaluation and Risk Management Strategy

Risk management is the silent partner in successful trading, often determining whether traders prosper or falter. We Fund Traders facilitates rigorous risk management by imposing strategic limits and targets. The daily loss limit of 5% encourages a disciplined approach to trading, compelling participants to stay vigilant about their positions.

When contrasted with many other proprietary trading firms, this structured limit helps define a safety net that is essential for maintaining sustainability in trading. Additionally, the maximum drawdown cap of 6% reinforces the importance of risk control, ensuring that emotionally driven trading does not spiral out of control.

The requirement for traders to achieve a profit target of 10% under these parameters cultivates a healthy pressure to perform while simultaneously imparting essential lessons in discipline. This strategy is vital, as research indicates that emotional trading decisions often lead to substantial losses. Furthermore, leverage set at 1:20 allows traders to maximize their positions without exposing themselves to irresponsible risk levels. Compared to typical industry standards, this framework exemplifies clarity and responsibility.

Challenges and Areas for Improvement

While We Fund Traders offers a lot of appealing features, it’s essential to consider some areas where the firm could improve. A common sentiment reflected in reviews points towards a desire for greater transparency regarding the firm’s rules and objectives. Many traders appreciate detailed guidelines outlining expectations, which can mitigate confusion and enhance trust. This is especially critical for newcomers who may be apprehensive about jumping into a complex environment with limited information.

Without comprehensive initial information about specific conditions, traders might find themselves in delicate situations where assumptions could lead to costly mistakes. Therefore, fostering open lines of communication and providing detailed resources or FAQs might significantly enhance customer experience.

Another area of potential is the integration of advanced trading tools or algorithms that could further enrich the learning experience. By incorporating analytics tools or even simulated environments for testing various strategies, traders could have access to an enriched educational backdrop, enabling them to refine their tactics in a risk-free setting.

Conclusion

In conclusion, We Fund Traders – The Whale Order presents itself as a compelling option for traders seeking both educational growth and funding opportunities. The firm’s dedication to mentoring and community building stands out, equipping participants with the skills necessary to navigate the trading world effectively.

Nevertheless, potential participants should conduct diligent research and weigh the benefits alongside the areas for improvement before immersing themselves in the Trading Whale Order experience. By embracing not only the knowledge, tools, and capital provided, but also encouraging feedback for an evolving program, traders can strive for unprecedented success in their trading endeavors.

Frequently Asked Questions:

Innovation in Business Models: We use a group purchase approach that enables users to split expenses and get discounted access to well-liked courses. Despite worries regarding distribution strategies from content creators, this strategy helps people with low incomes.

Legal Aspects to Take into Account: Our operations’ legality entails several intricate considerations. There are no explicit resale restrictions mentioned at the time of purchase, even though we do not have the course developers’ express consent to redistribute their content. This uncertainty gives us the chance to offer reasonably priced instructional materials.

Quality Control: We make certain that every course resource we buy is the exact same as what the authors themselves provide. It’s crucial to realize, nevertheless, that we are not authorized suppliers. Therefore, the following are not included in our offerings: – Live coaching sessions or calls with the course author.

– Entry to groups or portals that are only available to authors.

– Participation in closed forums.

– Straightforward email assistance from the writer or their group.

Our goal is to lower the barrier to education by providing these courses on our own, without the official channels’ premium services. We value your comprehension of our distinct methodology.

Be the first to review “We Fund Traders – The Whale Order” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

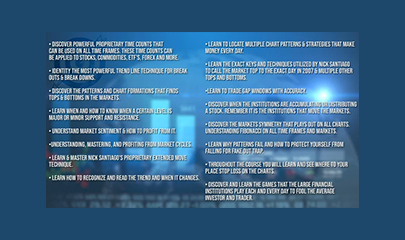

Options Trading with Nick And Gareth By Nick Santiago And Gareth Soloway – InTheMoneyStocks

Reviews

There are no reviews yet.