-

×

Introduction to Cross-Stitch By Lisa Shaffer

1 × $5,00

Introduction to Cross-Stitch By Lisa Shaffer

1 × $5,00 -

×

The Mango Butterfly Deep Dive 2023 By Jay Bailey And Sheridan Options Mentoring

1 × $31,00

The Mango Butterfly Deep Dive 2023 By Jay Bailey And Sheridan Options Mentoring

1 × $31,00 -

×

Advanced Mixing and Sound Design for Podcasters By Jim Briggs

1 × $5,00

Advanced Mixing and Sound Design for Podcasters By Jim Briggs

1 × $5,00 -

×

Behavioral Economics: When Psychology and Economics Collide By Scott Huettel

1 × $5,00

Behavioral Economics: When Psychology and Economics Collide By Scott Huettel

1 × $5,00 -

×

Secrets of a Winning Trader By Gareth Soloway

1 × $871,00

Secrets of a Winning Trader By Gareth Soloway

1 × $871,00 -

×

Extended Stays for Landlords By Al Williamson

1 × $419,00

Extended Stays for Landlords By Al Williamson

1 × $419,00 -

×

Brand Authority Profits By Dan Henry

1 × $39,00

Brand Authority Profits By Dan Henry

1 × $39,00 -

×

Master Lover 2023 - Secrets For Mystical Sexual Union By Tantra Garden

1 × $69,00

Master Lover 2023 - Secrets For Mystical Sexual Union By Tantra Garden

1 × $69,00 -

×

The Virtual Workshop By John Wineland

1 × $39,00

The Virtual Workshop By John Wineland

1 × $39,00 -

×

MovNat Mobility Bundle By MovNat

1 × $54,00

MovNat Mobility Bundle By MovNat

1 × $54,00 -

×

The Federal Code Blueprint 2023 2.0 By Jason White

1 × $23,00

The Federal Code Blueprint 2023 2.0 By Jason White

1 × $23,00 -

×

Gnosticism: From Nag Hammadi to the Gospel of Judas By David Brakke

1 × $5,00

Gnosticism: From Nag Hammadi to the Gospel of Judas By David Brakke

1 × $5,00 -

×

Mailbox Money Machine By Lisa Song Sutton

1 × $23,00

Mailbox Money Machine By Lisa Song Sutton

1 × $23,00 -

×

The Accelerated MTR Blueprint Masterclass 2023 By Jesse Vasquez

1 × $699,00

The Accelerated MTR Blueprint Masterclass 2023 By Jesse Vasquez

1 × $699,00 -

×

How To Write The Perfect Email By Justin Kerr

1 × $5,00

How To Write The Perfect Email By Justin Kerr

1 × $5,00 -

×

Scratch DJ Academy presents: Using Serato: Intermediate By DJ Hapa

1 × $5,00

Scratch DJ Academy presents: Using Serato: Intermediate By DJ Hapa

1 × $5,00 -

×

Books That Matter: The History of the Decline and Fall of the Roman Empire By Leo Damrosch

1 × $5,00

Books That Matter: The History of the Decline and Fall of the Roman Empire By Leo Damrosch

1 × $5,00 -

×

Day Trading with Volume Profile and Orderflow By Price Action Volume Trader

1 × $46,00

Day Trading with Volume Profile and Orderflow By Price Action Volume Trader

1 × $46,00 -

×

The Methodology Revealed By Nick Santiago And Gareth Soloway - InTheMoneyStocks

1 × $209,00

The Methodology Revealed By Nick Santiago And Gareth Soloway - InTheMoneyStocks

1 × $209,00

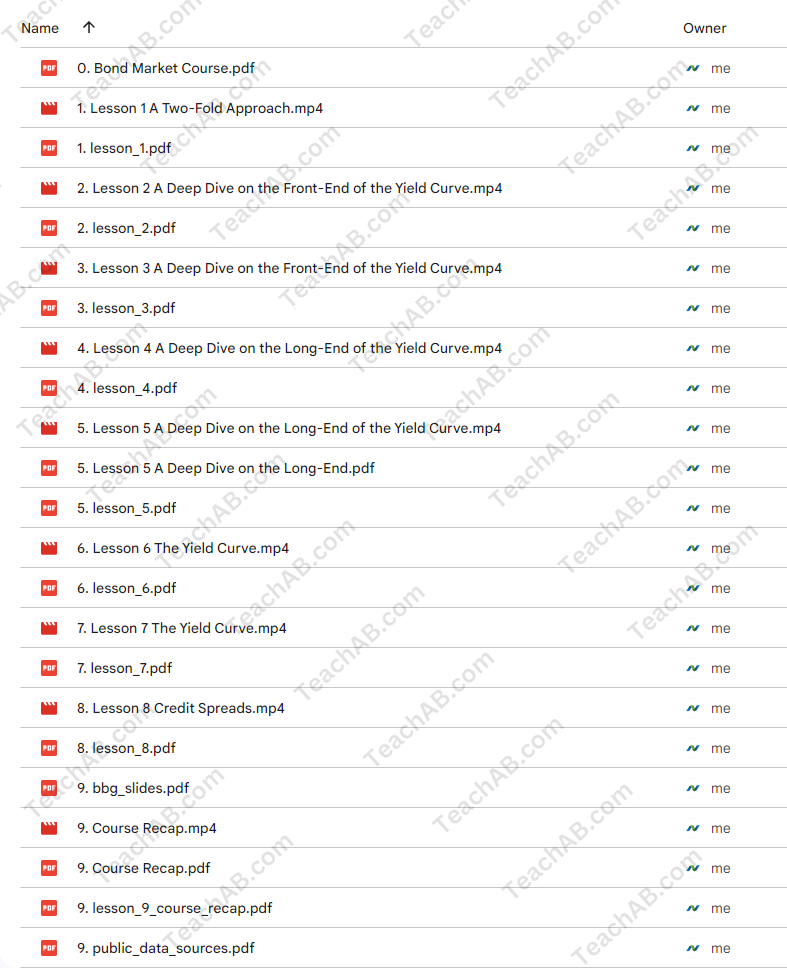

Bond Market Course By The Macro Compass

$499,00 $15,00

Bond Market Course By The Macro Compass – Instant Download!

Description:

Bond Market Course By The Macro Compass

Bond Market Course

Being a macro investor without deeply understanding the bond market is like eating soup with a fork: you can somehow make it, but it’s hard and unproductive.

The bond market scares many away as it’s full of jargon and insider-only knowledge, but that ends today with Alf’s Bond Market Course!

Course Overview

Lesson 1: A Two-Fold Approach To Really Understand The Bond Market

The combination of Alf’s macro and technical approach will turbo-boost your understanding of the mechanics behind bond yields.

Lesson 2+3: A Deep Dive on the Front-End of the Yield Curve

It all starts at the front-end of the yield curve: Central Banks exert a strong influence on short-term yields but there are many nuances to understand together.

Government bonds, OIS, interbank rates, repo markets…are you ready for it?

Lesson 4+5: A Deep Dive on the Long-End of the Yield Curve

Let’s shift our focus to the long-end of bond markets and study what drives the decision making of the biggest buyers in the world, the macro drivers behind long-end rates and how to get an edge in studying the macro cycle through bond yields!

Lesson 6-7: The Yield Curve

Yes, here we are: Dr. Yield Curve! This lesson is a primer on studying the mechanics by which the yield curve shape affects the economic cycle. But not only that: we will study all yield curve regimes and their impact on other asset classes so that your portfolio is always prepared for the macro cycle!

Lesson 8: Credit Spreads

Credit spreads are an important macro variable to keep track of as they determine how cheap/expensive leverage is for the private sector. In this lesson we unpack the macro and technical aspects of credit markets!

Course Recap

A quick recap tour of all you learnt.

Here you also find a super useful set of slide that guides you through all the (public) data sources where you can keep track of all these variables and apply everything you learnt in this Bond Market Course!

Frequently Asked Questions:

1. Innovative Business Model:

- Embrace the reality of a genuine business! Our strategy involves orchestrating a group purchase, wherein we collectively distribute costs among members. Utilizing these pooled funds, we acquire in-demand courses from sales pages and make them accessible to individuals facing financial constraints. Despite potential reservations from the original authors, our customers value the affordability and accessibility we offer.

2. The Legal Landscape: Yes and No:

- The legality of our operations resides in a gray area. While we lack explicit approval from course authors for resale, a legal nuance comes into play. During the course acquisition, the author did not specify any restrictions on resale. This legal intricacy presents both an opportunity for us and a benefit for those seeking budget-friendly access.

3. Quality Assurance: Revealing the Real Deal:

- Delving into the core of the matter – quality. Procuring the course directly from the sales page ensures that all documents and materials are identical to those obtained through conventional means. However, our differentiator lies in going beyond individual study; we take an extra step by facilitating resale. It’s crucial to note that we are not the official course providers, which means certain premium services are not included in our package:

- No coaching calls or scheduled sessions with the author.

- No access to the author’s private Facebook group or web portal.

- No entry to the author’s exclusive membership forum.

- No direct email support from the author or their team.

We operate independently, aiming to bridge the affordability gap without the additional services offered by official course channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Bond Market Course By The Macro Compass” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action By Aiman Almansoori

Reviews

There are no reviews yet.