-

×

The Holy Land Revealed By Jodi Magness

1 × $5,00

The Holy Land Revealed By Jodi Magness

1 × $5,00 -

×

Master Phone Training By Andy Elliott

1 × $194,00

Master Phone Training By Andy Elliott

1 × $194,00 -

×

The Be More Persuasive Hypnosis 5-Pack By Uncommon Knowledge

1 × $15,00

The Be More Persuasive Hypnosis 5-Pack By Uncommon Knowledge

1 × $15,00 -

×

The Complete Course of Ayurveda 3.0 By Jai Dev Singh - Life Force Academy

1 × $148,00

The Complete Course of Ayurveda 3.0 By Jai Dev Singh - Life Force Academy

1 × $148,00 -

×

Effortless Attraction Playbook: The secret model that a nerdy college guy discovered to get unlimited sex By Superman

1 × $15,00

Effortless Attraction Playbook: The secret model that a nerdy college guy discovered to get unlimited sex By Superman

1 × $15,00 -

×

DARK DRONES SOUND FX By Ocular Sounds

1 × $4,00

DARK DRONES SOUND FX By Ocular Sounds

1 × $4,00 -

×

The Branding, Marketing And Social Media Course By Andy Elliott

1 × $124,00

The Branding, Marketing And Social Media Course By Andy Elliott

1 × $124,00 -

×

How You Decide: The Science of Human Decision Making By Ryan Hamilton

1 × $5,00

How You Decide: The Science of Human Decision Making By Ryan Hamilton

1 × $5,00 -

×

Splitting Synesthesias within the Rhizome By John Overdurf

1 × $23,00

Splitting Synesthesias within the Rhizome By John Overdurf

1 × $23,00 -

×

Reading Biblical Literature: Genesis to Revelation By Craig Koester

1 × $5,00

Reading Biblical Literature: Genesis to Revelation By Craig Koester

1 × $5,00 -

×

Product Marketing Bootcamp By Melinda Chung

1 × $85,00

Product Marketing Bootcamp By Melinda Chung

1 × $85,00 -

×

Beethoven's Piano Sonatas By Robert Greenberg

1 × $5,00

Beethoven's Piano Sonatas By Robert Greenberg

1 × $5,00 -

×

Quantum Awakening By Roy Martina

1 × $124,00

Quantum Awakening By Roy Martina

1 × $124,00 -

×

Twitter Masterclass Recordings By Cold Email Wizard

1 × $39,00

Twitter Masterclass Recordings By Cold Email Wizard

1 × $39,00 -

×

Real Estate Video Pro By Channel Junkies

1 × $15,00

Real Estate Video Pro By Channel Junkies

1 × $15,00 -

×

Wing Tsun Bundle - Vol 1-11 By Sifu Niko

1 × $78,00

Wing Tsun Bundle - Vol 1-11 By Sifu Niko

1 × $78,00 -

×

The Others Within Us - Unattached Burdens and Guides in IFS Therapy By Robert Falconer

1 × $69,00

The Others Within Us - Unattached Burdens and Guides in IFS Therapy By Robert Falconer

1 × $69,00 -

×

Forex: Trading Forex With Banks

1 × $5,00

Forex: Trading Forex With Banks

1 × $5,00 -

×

The ClickMinded Sales Funnels Course By Jim Huffman - ClickMinded

1 × $171,00

The ClickMinded Sales Funnels Course By Jim Huffman - ClickMinded

1 × $171,00 -

×

History Greatest Voyages of Exploration By Vejas Gabriel Liulevicius

1 × $5,00

History Greatest Voyages of Exploration By Vejas Gabriel Liulevicius

1 × $5,00 -

×

Super Shoulders By Got Rom

1 × $23,00

Super Shoulders By Got Rom

1 × $23,00 -

×

Corrective Exercise Specialist Certification By AMN Academy

1 × $109,00

Corrective Exercise Specialist Certification By AMN Academy

1 × $109,00 -

×

Training Session - Guard position by Renzo Gracie

1 × $6,00

Training Session - Guard position by Renzo Gracie

1 × $6,00 -

×

Peptide Therapy: Foundations Course By William Seeds

1 × $248,00

Peptide Therapy: Foundations Course By William Seeds

1 × $248,00 -

×

Astrology 101 By Rick Levine & Kaedrich Olsen - Gaia

1 × $5,00

Astrology 101 By Rick Levine & Kaedrich Olsen - Gaia

1 × $5,00 -

×

Cultural Literacy for Religion: Everything the Well-Educated Person Should Know By Mark Berkson

1 × $5,00

Cultural Literacy for Religion: Everything the Well-Educated Person Should Know By Mark Berkson

1 × $5,00 -

×

The History and Achievements of the Islamic Golden Age By Eamonn Gearon

1 × $5,00

The History and Achievements of the Islamic Golden Age By Eamonn Gearon

1 × $5,00 -

×

Dynamic Hypnosis for Pain Control By Michael Ellner - Scott Sandland

1 × $31,00

Dynamic Hypnosis for Pain Control By Michael Ellner - Scott Sandland

1 × $31,00 -

×

Clear Xing Yi Quan - Clear Martial Arts By Richard Clear

1 × $155,00

Clear Xing Yi Quan - Clear Martial Arts By Richard Clear

1 × $155,00 -

×

Affiliate Marketing Business Blueprint By David Sharpe

1 × $31,00

Affiliate Marketing Business Blueprint By David Sharpe

1 × $31,00 -

×

6 Powerful Steps for Business Empowerment (Videos Only) By John Demartini

1 × $31,00

6 Powerful Steps for Business Empowerment (Videos Only) By John Demartini

1 × $31,00 -

×

Elliot Wave Techniques Simplified: How to Use the Probability Matrix to Profit on More Trades by Bennett McDowell

1 × $15,00

Elliot Wave Techniques Simplified: How to Use the Probability Matrix to Profit on More Trades by Bennett McDowell

1 × $15,00 -

×

Bookkeeping for Etsy Sellers By Lauren Venell

1 × $5,00

Bookkeeping for Etsy Sellers By Lauren Venell

1 × $5,00 -

×

Another Look with Frans Lanting By Frans Lanting

1 × $5,00

Another Look with Frans Lanting By Frans Lanting

1 × $5,00 -

×

How To Coach A Keynote By Dia Bondi

1 × $5,00

How To Coach A Keynote By Dia Bondi

1 × $5,00 -

×

Mount: control and submissions by Paulo Guillobel

1 × $6,00

Mount: control and submissions by Paulo Guillobel

1 × $6,00 -

×

Dave Mac's Push Ads Course By Dave Mac

1 × $31,00

Dave Mac's Push Ads Course By Dave Mac

1 × $31,00 -

×

CRACK THE TINDER ALGORITHM By Leon White

1 × $15,00

CRACK THE TINDER ALGORITHM By Leon White

1 × $15,00 -

×

Ultimate Guide to HARO Success By Easy Peasy Blogging

1 × $15,00

Ultimate Guide to HARO Success By Easy Peasy Blogging

1 × $15,00 -

×

The Performance Stretch System Level 1 By The Stretch Therapists

1 × $139,00

The Performance Stretch System Level 1 By The Stretch Therapists

1 × $139,00 -

×

Gnosticism: From Nag Hammadi to the Gospel of Judas By David Brakke

1 × $5,00

Gnosticism: From Nag Hammadi to the Gospel of Judas By David Brakke

1 × $5,00 -

×

Minerals And Crystals for Times of Stress

1 × $93,00

Minerals And Crystals for Times of Stress

1 × $93,00 -

×

ProfileMate 2023 By Luke Maguire

1 × $15,00

ProfileMate 2023 By Luke Maguire

1 × $15,00 -

×

Fengshui For Real Estate 2022 From Marie Diamond

1 × $39,00

Fengshui For Real Estate 2022 From Marie Diamond

1 × $39,00 -

×

The Accidental Sex Therapist: Sex Therapy Tools Anyone Can Use By Stephen Snyder

1 × $15,00

The Accidental Sex Therapist: Sex Therapy Tools Anyone Can Use By Stephen Snyder

1 × $15,00 -

×

The Irish Identity: Independence, History, and Literature By Marc Conner

1 × $5,00

The Irish Identity: Independence, History, and Literature By Marc Conner

1 × $5,00 -

×

The SMMA Academy Plus 2023 By Sander Stage

1 × $23,00

The SMMA Academy Plus 2023 By Sander Stage

1 × $23,00 -

×

Conscious Cashflow Triad By Jesse Elder

1 × $101,00

Conscious Cashflow Triad By Jesse Elder

1 × $101,00 -

×

Apollo 11: Lessons for All time By Vejas Gabriel Liulevicius, Robert Hazen & Edward Murphy

1 × $5,00

Apollo 11: Lessons for All time By Vejas Gabriel Liulevicius, Robert Hazen & Edward Murphy

1 × $5,00 -

×

Double Calendars And Double Diagonals 2022 By Sheridan Options Mentoring

1 × $109,00

Double Calendars And Double Diagonals 2022 By Sheridan Options Mentoring

1 × $109,00 -

×

Online Forex University Course

1 × $10,00

Online Forex University Course

1 × $10,00 -

×

Orchestrating Your Inner Voices By John Overdurf

1 × $31,00

Orchestrating Your Inner Voices By John Overdurf

1 × $31,00 -

×

Bank And Financial Institution Modeling 2024 By Breaking Into Wall Street

1 × $109,00

Bank And Financial Institution Modeling 2024 By Breaking Into Wall Street

1 × $109,00 -

×

2 Phase AI Trade Spy Total Immersion Experience By Jeff Bierman - The Quant Guy

1 × $209,00

2 Phase AI Trade Spy Total Immersion Experience By Jeff Bierman - The Quant Guy

1 × $209,00 -

×

Sharp Edge Institutional Ultimate Trade Program – CompassFX

1 × $101,00

Sharp Edge Institutional Ultimate Trade Program – CompassFX

1 × $101,00 -

×

PUA Cribs: Project Bel-Air by Johnny Wolf

1 × $5,00

PUA Cribs: Project Bel-Air by Johnny Wolf

1 × $5,00 -

×

Copy Legends Lock-In Recordings By Todd Brown

1 × $31,00

Copy Legends Lock-In Recordings By Todd Brown

1 × $31,00 -

×

8 Week AI Bootcamp for Printables and Print on Demand Strategies By Rachel Rofe

1 × $23,00

8 Week AI Bootcamp for Printables and Print on Demand Strategies By Rachel Rofe

1 × $23,00 -

×

MUSICAL DRONES SOUND FX By Ocular Sounds

1 × $4,00

MUSICAL DRONES SOUND FX By Ocular Sounds

1 × $4,00 -

×

Books That Matter: The History of the Decline and Fall of the Roman Empire By Leo Damrosch

1 × $5,00

Books That Matter: The History of the Decline and Fall of the Roman Empire By Leo Damrosch

1 × $5,00 -

×

Connect and Channel Wisdom Through Your Spirit Guides by Sheila Vijeyarasa

1 × $54,00

Connect and Channel Wisdom Through Your Spirit Guides by Sheila Vijeyarasa

1 × $54,00

Corporate Restructuring By Wall Street Prep

$399,00 $85,00

Corporate Restructuring By Wall Street Prep – Instant Download!

Description:

Corporate Restructuring By Wall Street Prep

Corporate Restructuring

Learn the central considerations and dynamics of both in- and out-of-court restructuring along with major terms, concepts, and common restructuring techniques. Includes 2 Bonus Courses: Restructuring Modeling and Restructuring Primer for Junior Bankers.

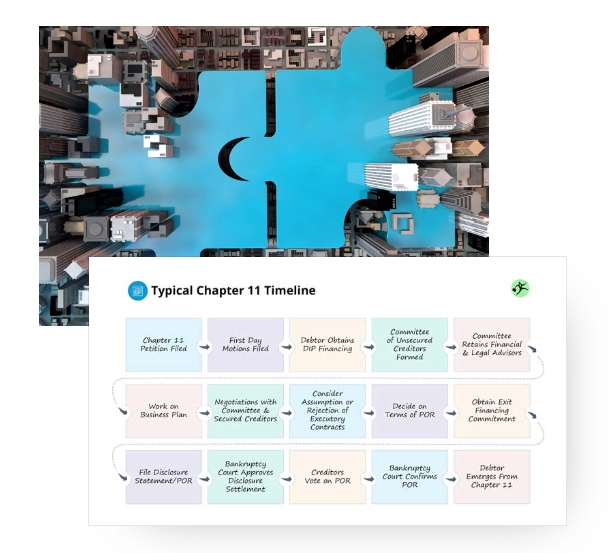

Understand the Restructuring and Bankruptcy Process

Step-by-Step Video and Real Case Studies

Using real case studies and a step-by-step approach, you will learn the central considerations and dynamics of both out-of-court and in-court restructuring, along with major terms, concepts, and common restructuring techniques.

Taught by Experienced Restructuring Instructor-Practitioners

This is the same training program Wall Street Prep delivers to restructuring groups at some of the world’s top investment banks. It is taught by former investment bankers who have worked on high-profile corporate restructuring deals.

What You Will Learn

COURSE 1: UNDERSTANDING CORPORATE RESTRUCTURING

The Restructuring & Bankruptcy Framework

- Explore the various factors that lead to financial distress.

- Learn how to impute asset values based on market prices for a company’s equity and debt trading levels.

- Connect the concept of reorganization value to more traditional valuation concepts like enterprise value.

- Understand priority of claims.

- Learn how inter-creditor agreements, secured vs unsecured, maturity and corporate structure all play a role in restructuring outcomes.

- Explore how the competing motivations and interests of the stakeholders in restructuring all impact the process.

Valuation & Recovery Analysis and Distressed M&A

- Dive deeper into common analyses, including valuation based on management projections, liquidity analysis, a recovery waterfall, and potential equity value post emergence.

- Learn how restructuring fits within a variety of strategic alternatives for firms under distress.

- Understand the mechanics of credit bidding and 363 sales

- Model valuation and capital structure scenarios and the impact on recoveries to the various creditors.

BONUS COURSE: RESTRUCTURING MODELING

Model some of the most challenging aspects of a bankruptcy, including:

- Working capital reclassifications such as critical vendors/AP.

- DIP financing, borrowing base and availability calculations, adequate protection payments.

- Balance sheet roll-forward schedules that maintain a consistent link structure to the cash flow statement and increase transparency.

- Fees, rejection claims and CODI.

- Model recoveries at various operating scenarios.

- Construction of a recovery waterfall that can accommodate scenarios that deviate from the absolute priority rule.

- Using conditional formatting and Excel’s native date formulas to sensitize for different filing and emergence date scenarios.

- Avoiding circular references in the model while maintaining model integrity.

- Incorporating best practices for error-proofing, auditing, and model efficiency.

- Understanding how Fresh Start Accounting affects the model.

BONUS COURSE: DEMYSTIFYING RESTRUCTURING INVESTMENT BANKING

- For incoming restructuring bankers and current bankers looking to further their restructuring or distressed debt knowledge.

- Restructuring IB process overview.

- Learn the skills you’ll need early in your IB career.

- Walk through the analyses and modeling-related techniques used by early-career IB analysts and associates using a case-study.

- Assumes little to no prior knowledge of restructuring.

Who is This Program For?

- Restructuring Investment Banking Professionals

- Distressed Debt Investors

- FP&A and Corporate Finance

- Turnaround Consultants & Advisors

- Private Equity Professionals

- Anyone interested in corporate restructuring

What’s Included

Understanding Corporate Restructuring

Using real case studies and a step-by-step approach, learners will be introduced to the central considerations and dynamics of both out-of-court and in-court restructuring, along with major terms, concepts, and common restructuring techniques.

Learners will explore the various factors that lead to financial distress and how to impute asset values based on market prices for a company’s equity and debt trading levels and connect the concept of reorganization value to more traditional valuation concepts like enterprise value.

- Introduction to Corporate Financial Restructuring

- Restructuring Plan Basics

- Valuation

- Priority – Additional Considerations

- Plan Confirmation

- Vanguard Natural Resources

- Additional Topics

Restructuring Modeling

This course is designed to teach restructuring and bankruptcy modeling to students and professionals pursuing careers in restructuring, bankruptcy and distress. Using the Borders bankruptcy as our primary case study, we begin with an overview of the restructuring and bankruptcy framework. Then we will learn to build an advanced bankruptcy model from scratch, incorporating bankruptcy specific elements like DIP financing, the creation of liabilities subject to compromise, working capital drivers, cancellation of debt income, and Fresh Start accounting. We conclude the course with valuation analysis and a recovery analysis, where we will layer various valuation scenarios onto the model to analyze possible recoveries to the various creditors.

- Chapter 1: Restructuring Primer

- Chapter 2: Restructuring Modeling Program

Demystifying Restructuring Investment Banking for Incoming Analysts and Associates

This course is designed for incoming restructuring bankers and current bankers looking to further their restructuring or distressed debt knowledge. It provides an in-depth overview of restructuring and identify the skills you’ll need in the early days of your restructuring IB career. We begin by introducing the restructuring process as well as common pitchbook and financial analyses in restructuring IB. From there, we take more in-depth look at the analyses and modeling-related techniques utilized by analysts and associates early in their restructuring banking careers. This course assumes little to no prior knowledge of restructuring. Less

- Demystifying Restructuring Investment Banking for Incoming Analysts and Associates

Course Highlights

- Used on the Street

This is the same comprehensive course our corporate clients use to prepare their analysts and associates. - Real Case Studies

This course uses actual financial filings to show how restructuring is done in the real world. - Taught by Bankers

Our instructors are former I-bankers who give lessons real-world context by connecting it to their experience on the desk.

Tags: Corporate Restructuring By Wall Street Prep, Corporate Restructuring By Wall Street Prep, Corporate Restructuring By Wall Street Prep, Corporate Restructuring By Wall Street Prep, Corporate Restructuring By Wall Street Prep

Frequently Asked Questions:

1. Innovative Business Model:

- Embrace the reality of a genuine business! Our strategy involves orchestrating a group purchase, wherein we collectively distribute costs among members. Utilizing these pooled funds, we acquire in-demand courses from sales pages and make them accessible to individuals facing financial constraints. Despite potential reservations from the original authors, our customers value the affordability and accessibility we offer.

2. The Legal Landscape: Yes and No:

- The legality of our operations resides in a gray area. While we lack explicit approval from course authors for resale, a legal nuance comes into play. During the course acquisition, the author did not specify any restrictions on resale. This legal intricacy presents both an opportunity for us and a benefit for those seeking budget-friendly access.

3. Quality Assurance: Revealing the Real Deal:

- Delving into the core of the matter – quality. Procuring the course directly from the sales page ensures that all documents and materials are identical to those obtained through conventional means. However, our differentiator lies in going beyond individual study; we take an extra step by facilitating resale. It’s crucial to note that we are not the official course providers, which means certain premium services are not included in our package:

- No coaching calls or scheduled sessions with the author.

- No access to the author’s private Facebook group or web portal.

- No entry to the author’s exclusive membership forum.

- No direct email support from the author or their team.

We operate independently, aiming to bridge the affordability gap without the additional services offered by official course channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Corporate Restructuring By Wall Street Prep” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.