-

×

Google Discover Playbook By Tony Hill

1 × $31,00

Google Discover Playbook By Tony Hill

1 × $31,00 -

×

The Ultimate Guide to Rehabbing By William Bronchick

1 × $31,00

The Ultimate Guide to Rehabbing By William Bronchick

1 × $31,00 -

×

The ClickMinded Sales Funnels Course By Jim Huffman - ClickMinded

1 × $171,00

The ClickMinded Sales Funnels Course By Jim Huffman - ClickMinded

1 × $171,00 -

×

Compound Butterfly Blueprint (Elite Package) By Allison Ostrander - Simpler Trading

1 × $62,00

Compound Butterfly Blueprint (Elite Package) By Allison Ostrander - Simpler Trading

1 × $62,00 -

×

Image Formats for Beginners By Jason Hoppe

1 × $5,00

Image Formats for Beginners By Jason Hoppe

1 × $5,00 -

×

Conscious Cashflow Triad By Jesse Elder

1 × $101,00

Conscious Cashflow Triad By Jesse Elder

1 × $101,00 -

×

The Voice Acting Academy By Joe Zieja

1 × $78,00

The Voice Acting Academy By Joe Zieja

1 × $78,00 -

×

The Accelerated MTR Blueprint Masterclass 2023 By Jesse Vasquez

1 × $699,00

The Accelerated MTR Blueprint Masterclass 2023 By Jesse Vasquez

1 × $699,00 -

×

Semen Retention Mastery By Taylor Johnson

1 × $23,00

Semen Retention Mastery By Taylor Johnson

1 × $23,00 -

×

The Shaft Method Course For Men By Shaft Uddin

1 × $132,00

The Shaft Method Course For Men By Shaft Uddin

1 × $132,00 -

×

Hedged Strategy Series in Volatile Markets All 4 By Dan Sheridan

1 × $15,00

Hedged Strategy Series in Volatile Markets All 4 By Dan Sheridan

1 × $15,00 -

×

The History of Christianity: From the Disciples to the Dawn of the Reformation By Luke Timothy Johnson

1 × $5,00

The History of Christianity: From the Disciples to the Dawn of the Reformation By Luke Timothy Johnson

1 × $5,00 -

×

The Others Within Us - Unattached Burdens and Guides in IFS Therapy By Robert Falconer

1 × $69,00

The Others Within Us - Unattached Burdens and Guides in IFS Therapy By Robert Falconer

1 × $69,00 -

×

Natural Instinct Method - RSD Nation

1 × $5,00

Natural Instinct Method - RSD Nation

1 × $5,00 -

×

Capital Club Academy

1 × $31,00

Capital Club Academy

1 × $31,00 -

×

Writing Great Chapters By Daniel David Wallace

1 × $23,00

Writing Great Chapters By Daniel David Wallace

1 × $23,00 -

×

Make Small Talk Sexy 2.0 by Bobby Rio

1 × $5,00

Make Small Talk Sexy 2.0 by Bobby Rio

1 × $5,00 -

×

Orgasmic, Tantric And Erotic Hypnosis By David Mears

1 × $163,00

Orgasmic, Tantric And Erotic Hypnosis By David Mears

1 × $163,00 -

×

Master Phone Training By Andy Elliott

1 × $194,00

Master Phone Training By Andy Elliott

1 × $194,00 -

×

Fort Worth Playboy Evergreen VIP Bundle

1 × $69,00

Fort Worth Playboy Evergreen VIP Bundle

1 × $69,00 -

×

Land Listings Unleashed By Cody Bjugan And David Hill - Vestright

1 × $279,00

Land Listings Unleashed By Cody Bjugan And David Hill - Vestright

1 × $279,00 -

×

Mastering The Mental MAP Seminar By Brendan Vermeire

1 × $194,00

Mastering The Mental MAP Seminar By Brendan Vermeire

1 × $194,00 -

×

Adobe Photoshop Actions for Color | Carnivale Action by Kate Woodman

1 × $8,00

Adobe Photoshop Actions for Color | Carnivale Action by Kate Woodman

1 × $8,00 -

×

Seven Figure Freedom By Michael Killen

1 × $62,00

Seven Figure Freedom By Michael Killen

1 × $62,00 -

×

Agency Partner Program By Jason Wardrop

1 × $15,00

Agency Partner Program By Jason Wardrop

1 × $15,00 -

×

Rocket Ship Buy - Short Signal By Gareth Soloway - InTheMoneyStocks

1 × $31,00

Rocket Ship Buy - Short Signal By Gareth Soloway - InTheMoneyStocks

1 × $31,00 -

×

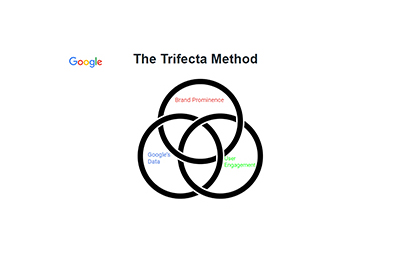

Ranking Google Business Profiles And The Local Trifecta Method By Brock Misner

1 × $23,00

Ranking Google Business Profiles And The Local Trifecta Method By Brock Misner

1 × $23,00 -

×

The Federal Code Blueprint 2023 2.0 By Jason White

1 × $23,00

The Federal Code Blueprint 2023 2.0 By Jason White

1 × $23,00 -

×

The Certified Physical Preparation Specialist Level 1 Premium (CPPS) By CPPS Academy

1 × $139,00

The Certified Physical Preparation Specialist Level 1 Premium (CPPS) By CPPS Academy

1 × $139,00 -

×

Online - The Demartini Values Training Program - USA 2020 (Videos Only) By Dr John Demartini

1 × $622,00

Online - The Demartini Values Training Program - USA 2020 (Videos Only) By Dr John Demartini

1 × $622,00 -

×

MovNat Mobility Bundle By MovNat

1 × $54,00

MovNat Mobility Bundle By MovNat

1 × $54,00 -

×

Web API - JavaScript Fetch getting JSON data Fun with APIs

1 × $6,00

Web API - JavaScript Fetch getting JSON data Fun with APIs

1 × $6,00 -

×

The Programs Course By Larry Crane - Release Technique

1 × $46,00

The Programs Course By Larry Crane - Release Technique

1 × $46,00 -

×

Foundr - All Courses Bundle

1 × $23,00

Foundr - All Courses Bundle

1 × $23,00 -

×

Bank And Financial Institution Modeling 2024 By Breaking Into Wall Street

1 × $109,00

Bank And Financial Institution Modeling 2024 By Breaking Into Wall Street

1 × $109,00

Real Estate Financial Modeling By Aaron Hancock – Wall Street Prep

$499,00 $54,00

SKU: 43965VKIzfKku

Category: Finance

Tags: Aaron Hancock, Real Estate Financial Modeling, Wall Street Prep

Real Estate Financial Modeling By Aaron Hancock – Wall Street Prep – Instant Download!

Description:

Real Estate Financial Modeling By Aaron Hancock – Wall Street Prep

Everything you need to build and interpret real estate finance models. This is the same training program we deliver to the world’s leading real estate private equity firms.

A Comprehensive Real Estate Financial Modeling Program

This course begins with the foundations of real estate finance and excel best practices, adding complexity piece by piece. By the end of the program, learners will build complete, industrial grade multifamily, office, retail and industrial models, including in depth treatment of the modeling of revenues, operating expenses, capital improvements, debt, and joint venture waterfalls

- Real estate financial modeling best practices

- Real estate investment and development theory

- How to utilize historical financials to build a multifamily acquisition model

- How to utilize Argus outputs to build a commercial acquisition model

- How to build a real estate development model

- How to model a debt schedule

- How to model a joint venture waterfall

This program includes the following 9 modules

Each module builds sequentially towards a complete understanding of the Real Estate model building process

Introduction to Real Estate Modeling

Section 1 of our Real Estate Financial Modeling Program. This course provides an introduction to the function of real estate financial models, the challenges presented by bespoke approaches, and Wall Street Prep’s approach to teaching Real Estate Financial Modeling. We will begin with a review of efficiency and formatting fundamentals that will be ..

Operating Cash Flow

Section 2 of our Real Estate Financial Modeling Program. Real estate is all about cash flow. This module will cover cash flow builds for multifamily and commercial property types. We will build the foundations of revenues and expenses and finish with a discussion on the importance of net operating income. Each section will begin with the characteri ..

Non-Operating Cash Flow

Section 3 of our Real Estate Financial Modeling Program. Although real estate is valued based on operating cash flow, non-operating cash flows are integral to business plans. This module will cover leasing costs for commercial properties, capital improvements and costs associated with buying and selling a property. After detailed discussions of the …

Debt & Levered Cash Flow

Section 4 of our Real Estate Financial Modeling Program. Real estate is a highly levered asset class and an understanding of leverage is critical for any real estate investor. This module will serve as a primer on real estate debt, covering everything from different ways to finance an acquisition, to key terms in loan documents and how to model an …

Joint Ventures & Waterfalls

Section 5 of our Real Estate Financial Modeling Program. The waterfall is infamously part of most real estate interview modeling tests. This module introduces joint ventures and the theory behind waterfalls. After introducing key terminology and reinforcing the underlying theory, considerable time will be spent on a step-by-step walkthrough of how …

Summarizing & Analyzing the Model

Section 6 of our Real Estate Financial Modeling Program. Real estate financial models are tools for projecting the cash flows of a potential investment. The cash flow projections alone are not enough to analyze a potential investment. This module will cover how to summarize the outputs of a model to form the basis of an analysis by discussing key m …

Development Modeling

Section 7 of our Real Estate Financial Modeling Program. Real estate can be bought or built. Up to this point, the course has been focused on buying property. This module will unpack the differences and similarities in modeling a development and an acquisition. Development specific topics such as construction budgets and lease-up will be covered as …

Office Building Acquisition Case Study

Section 8 of our Real Estate Financial Modeling Program. Building well-formatted and extensive models is the name of the game for those working for institutional firms or preparing materials for a potential investor. But, many situations – whether a modeling test or first pass at a potential personal investment – necessitate building a model quickl …

Multifamily Building Development Case Study

Section 9 of our Real Estate Financial Modeling Program. Building well-formatted and extensive models is the name of the game for those working for institutional firms or preparing materials for a potential investor. But, many situations – whether a modeling test or first pass at a potential personal investment – necessitate building a model quickl …

Get the Real Estate Financial Modeling Certification

Trainees are eligible to take the WSP Real Estate Financial Modeling Certification Exam for 24 months from the date of enrollment. Those who complete the exam and score above 70% will receive a the certification. The exam is a challenging online assessment that covers the most difficult concepts taught in the program.

Who is this program for?

This course is designed for individual investors as well as students and professionals pursuing careers in:

- Acquisitions

- Development

- Private Equity

- Asset Management

- Brokerage

- Lending

Frequently Asked Questions:

1. Innovative Business Model:

- Embrace the reality of a genuine business! Our strategy involves orchestrating a group purchase, wherein we collectively distribute costs among members. Utilizing these pooled funds, we acquire in-demand courses from sales pages and make them accessible to individuals facing financial constraints. Despite potential reservations from the original authors, our customers value the affordability and accessibility we offer.

2. The Legal Landscape: Yes and No:

- The legality of our operations resides in a gray area. While we lack explicit approval from course authors for resale, a legal nuance comes into play. During the course acquisition, the author did not specify any restrictions on resale. This legal intricacy presents both an opportunity for us and a benefit for those seeking budget-friendly access.

3. Quality Assurance: Revealing the Real Deal:

- Delving into the core of the matter – quality. Procuring the course directly from the sales page ensures that all documents and materials are identical to those obtained through conventional means. However, our differentiator lies in going beyond individual study; we take an extra step by facilitating resale. It’s crucial to note that we are not the official course providers, which means certain premium services are not included in our package:

- No coaching calls or scheduled sessions with the author.

- No access to the author’s private Facebook group or web portal.

- No entry to the author’s exclusive membership forum.

- No direct email support from the author or their team.

We operate independently, aiming to bridge the affordability gap without the additional services offered by official course channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Real Estate Financial Modeling By Aaron Hancock – Wall Street Prep” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.